Can the Greater Bay Area lure foreign investors? Beijing wants Hong Kong to draw international capital into region, but global firms still hazy about benefits

- Capital has been flowing into the bay area, but questions linger about its appeal to investors

- Geopolitics, tensions between the West and China have affected the bay area’s ability to perform better

February 18 marks five years since Beijing unveiled its blueprint to turn the Greater Bay Area into a hi-tech powerhouse by 2035. The region of more than 86 million people covers Hong Kong, Macau and nine Guangdong cities.

British architect Peter Brannan has a vivid memory of the first time he visited mainland China in 2000 on behalf of a Hong Kong client, 12 years after moving to the city.

“I always remember standing at the Guangzhou East Station and noticing the different types of Chinese people. You had people from the very north, you had Muslim Chinese, all sorts of different people,” he said.

Those were the early days of a boom in major construction and infrastructure projects that have transformed the cities across southern Guangdong province.

“Since 2000, there’s just been a huge, tremendous expansion of new buildings, new cities, new towns, new transport,” said Brannan, now a senior executive with US architectural firm Skidmore, Owings & Merrill (SOM), which has its regional headquarters in Hong Kong.

Home-grown developers and architects joined in the mainland construction boom, but Brannan maintained that international players such as Swire Properties and SOM made a difference.

“That’s where Hong Kong is,” he said. “Hong Kong and international developers, international architects brought quality to the table.”

Under Beijing’s ambitious plan to turn the region into a hi-tech economic powerhouse by 2025, Hong Kong’s role was to “attract investment in advanced manufacturing, modern service industries and strategic emerging industries from developed countries, and attract the headquarters of multinational companies and international organisations to settle in the Greater Bay Area”.

As the blueprint marks its fifth anniversary on February 18, there are questions about the region’s ability to attract foreign investors.

Foreign investments there slid by almost a fifth from 2022 to 62.62 billion yuan (US$8.76 billion) last year, although that was still 7.5 per cent more than in 2018.

Dongguan, a renowned manufacturing hub in the region, attracted 7.22 billion yuan of foreign investment last year, almost a quarter less than five years ago.

Not all cities in the region have reported their full-year foreign investment figures for last year, but available data suggests a decline.

The pattern was consistent throughout the mainland, which recorded 8 per cent less foreign investment last year compared with 2022, though the national total in 2023 was still 28 per cent higher than in 2018.

Apart from the impact of the pandemic, geopolitics and rising tensions between the West and China have played a part in the bay area’s inability to do better.

“Before 2016, lobbyists could often influence policies so that business and investment exchanges between China and the US were almost unhindered. Now, politicians all pursue an anti-China agenda or sanctions to curb the rise of China,” he said.

This year’s US presidential election, with Trump the front-runner for the Republican Party’s nomination, was an added source of uncertainty for Western investors.

Tang said Beijing’s crackdown on the real estate, for-profit tutoring and online gaming industries in recent years had also given investors the jitters, fearing their sector could be next.

A sentiment survey carried out by the American Chamber of Commerce in Hong Kong and released in January showed that 57 per cent of member firms operating in the bay area identified “policy and regulatory uncertainty” as their top challenge.

Almost two-fifths were concerned about “local competition”, indicating that they found it harder to face off against Chinese companies that had come up and were thriving in the bay area.

One of Hong Kong’s key roles in the bay area plan was to attract international companies to establish a presence in the region.

But in the five years since the blueprint was released, the number of regional headquarters or offices set up in Hong Kong by non-Chinese companies fell by 12.2 per cent.

The number of American regional head offices, for example, shrank from 290 in 2018 to 214 last year. Over that period, the number of Japanese headquarters fell from 244 to 206, while British ones decreased from 137 to 115.

Some of the companies still in Hong Kong might be trimming their operations in the city.

It has several ongoing town planning projects in the bay area, including riverside redevelopments in downtown Guangzhou, but these are being supervised by several of the company’s offices.

Hong Kong government statistics show that last year, 54 per cent of foreign firms’ regional headquarters in the city were also in charge of their operations in Guangdong, similar to the situation in 2018.

A survey by the German Chamber of Commerce in Hong Kong last year indicated that slightly more than a third of its members had investments in the bay area region, with less than a fifth of them expecting to increase investments there this year.

Chamber president Johannes Hack said many German companies in the city were in finance, logistics and sourcing, which did not necessarily have operations across the border.

Manufacturing firms with a heavy presence on the mainland had no need for a Hong Kong office, he added.

Direct investment in China by German firms rose by 4.3 per cent to a record 11.9 billion euros (US$12.7 billion) last year, according to a recent Reuters report.

A confidence survey released last month by the German Chamber of Commerce in China showed that out of the 566 members that responded, almost a third were located in Shanghai and just more than a tenth were in Guangdong province.

A third of the companies surveyed were involved in machinery production, and a fifth in automotive manufacturing.

Hack suggested that despite its ambitions to rival California’s Silicon Valley, the bay area had not yet established its identity and appeal to foreign investors.

He said global investors could not tell the benefits of being in the region compared with the rest of the mainland. The chamber’s survey showed that the bay area concept was not well understood by most of its members’ stakeholders outside Hong Kong.

Western investors were not clear what Beijing’s blueprint meant exactly, or how being in the region would help them.

“Dongguan is great for manufacturing and a lot of German companies know that, that’s why they are in Dongguan. So, no need to tell them because they’re already convinced,” he said.

But what would be the additional benefits of setting up in another bay area city? That was not clear, Hack said.

While Beijing’s blueprint emphasised the economic integration of Hong Kong and the mainland, he said the city’s real draw globally was its distinctiveness from the rest of China.

Recent years have seen what some have described as the “mainlandisation” of Hong Kong, with many mainlanders immigrating and more Mandarin being spoken, but Hack said the city needed to retain its cosmopolitan identity.

“Yes, it’s great if people speak Mandarin, but it’s really equally great if they speak English. And it’s not that Mandarin is great and English is nice to have. English is a need-to-have, Mandarin is also a need-to-have,” he said.

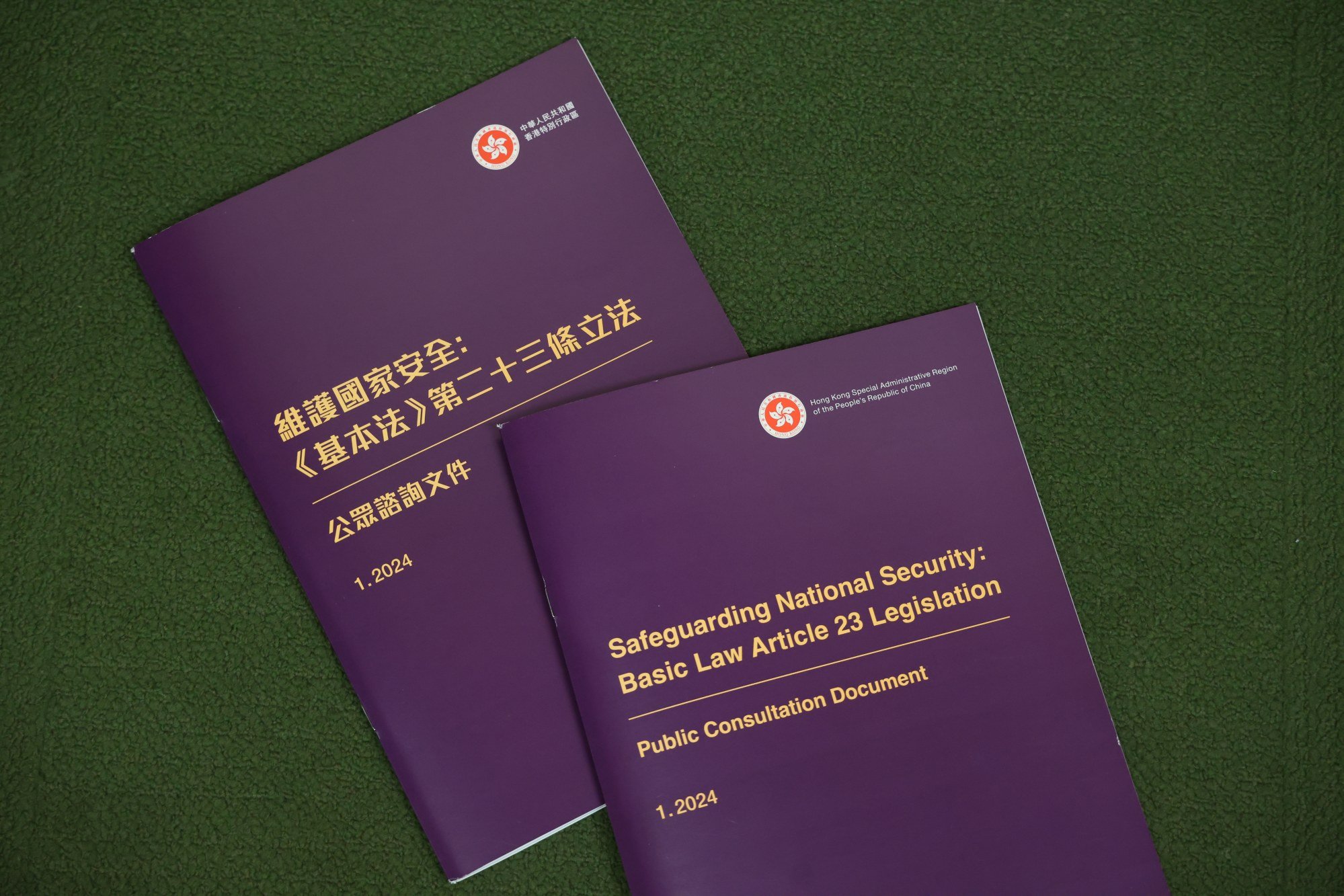

With the city administration’s current focus on internal security and threats, he said the rest of the world was not seeing much about “opportunities and cooperation” or how Hong Kong would remain cosmopolitan.

Basil Hwang, vice-chairman of the Singapore Chamber of Commerce, agreed that Hong Kong’s strengths and prospects as a gateway to the mainland lay in its cultural accessibility for Western businesses.

Singaporean businesses, for example, did not need to go through Hong Kong intermediaries to enjoy tax breaks when setting up mainland subsidiaries, and having a shared Chinese heritage helped too.

Hwang, an insolvency specialist and managing director of the law firm Hauzen LLP, said half its clients were from the mainland, with about half of them from the bay area.

He said insolvencies were “lagging indicators” that revealed what went wrong two or three years earlier.

“You’ll continue to see more insolvencies and more corporate restructurings and things like that on the mainland, but that is not reflective of what’s happening right now. I’m not seeing a lot of new insolvencies,” he said.

Wing Chu, a principal economist for the Hong Kong Trade Development Council, told the Post that authorities in the bay area had rolled out a variety of measures to streamline business operations.

They include an agreement between Hong Kong and Guangdong sealed last summer to enable the flow of personal data across the border in compliance with the law.

“The advantage of the Greater Bay Area is that when you come to Hong Kong, you also get access to the Greater Bay Area cities in Guangdong province,” he said. “As you grow, you can spread your presence to the entire mainland Chinese market. This is already happening.”

He said most foreign businesses that approached the council about setting up a company in Hong Kong were also interested in the Guangdong or the larger mainland market, though he added that it would take time to promote favourable “add-on” benefits because these were new initiatives.

For foreign businesses, the bay area made for greater convenience in their operations compared with before.

“Guangdong, Hong Kong and Macau are three customs territories, three different legal jurisdictions and three different economies.

“Now you can take advantage of the benefits of ‘one country, two systems’ [governing principle] in one jurisdiction and at the same time take advantage of the economic advantages of all three places.”