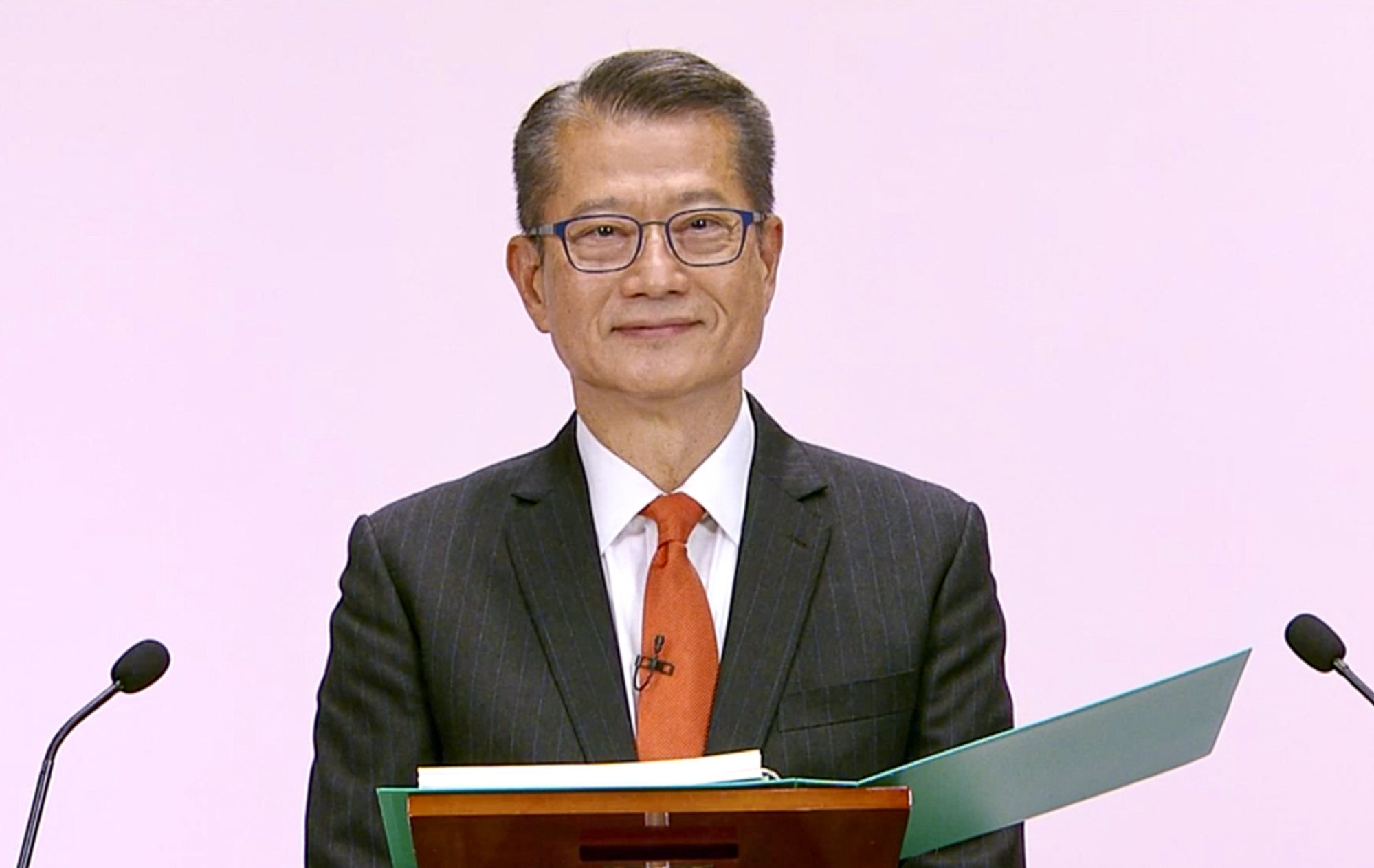

Sweeteners to ease Covid-19 pain: from vouchers and tax cuts to rent relief – 7 key takeaways from Hong Kong’s 2022-23 budget

- Financial Secretary Paul Chan’s HK$170 billion budget includes a substantial amount set aside for pandemic relief and public health measures

- It also lays out rental protections for small businesses, higher taxes for landlords and more consumption vouchers for everyday residents

Small businesses are in line for new rental protections, while major corporations and certain landlords can expect higher taxes in the coming financial year. Meanwhile, the government’s popular consumption vouchers are back and bigger than ever.

Here are seven key takeaways from the latest budget.

1. Double the vouchers

In a bid to boost spending, each of Hong Kong’s 6.6 million permanent residents and new immigrants from mainland China aged 18 and up will be given HK$10,000 in digital consumption vouchers, costing the government HK$66.4 billion in total.

The first instalment of HK$5,000 is expected to be handed out in April, while the second will be disbursed in August. Those who will not be 18 in April, but will be by July, can claim their first instalment then.

The initiative is a supersized reprise of a similar one last year in which all residents were given HK$5,000.

2. Tax deductions for renters, higher borrowing limit for buyers

Among the relief measures for residents was a new tax reduction starting from this financial year for those who rent their homes while also having to pay salaries tax or tax under personal assessment. The deduction is capped at HK$100,000 a year per person, and is projected to cost HK$3.3 billion in government revenue.

For property buyers, Chan said that in light of an anticipated rebound in housing supply, the government-backed Hong Kong Mortgage Corporation would raise the ceiling on first-home mortgages. Buyers will be able to borrow 90 per cent of a property’s value if the home is worth not more than HK$10 million. Currently they can enjoy this rate only for properties worth HK$8 million or less.

For those non-first-time buyers seeking to borrow 80 per cent of the property’s value, it should be worth not more than HK$12 million, up from HK$10 million previously.

Hong Kong budget: HK$10,000 spending vouchers, SMEs' 6-month rental relief

Other one-off measures to alleviate residents’ financial strain include a salaries tax cut of up to HK$10,000 for more than 2 million taxpayers, rates concessions totalling as much as HK$5,000 for residential properties, a HK$1,000 electricity tariff subsidy for each household, and fees for the city’s university entrance exams being waived for all students.

3. Rent relief for small businesses

In an unprecedented move, the government will quickly introduce a law to forbid landlords from terminating the leases of, halting services for, or taking legal action against “tenants of specified sectors” – mostly small to medium-sized enterprises (SMEs) – for failing to pay rent on time. Chan said this was to “provide enterprises in deep water with breathing space” and secure jobs.

The measure will be in force for three months, and extended for three more if necessary. The scheme mirrors a temporary law in Singapore introduced in 2020 that benefited SMEs.

Other relief measures for all businesses include profits tax cuts of up to HK$10,000, rates concessions, and partial waivers of water and sewage charges.

4. More resources for anti-pandemic fight

The Anti-epidemic Fund will set aside HK$12 billion for building isolation and treatment facilities. The government will further budget HK$22 billion to boost Covid-19 testing capacity and HK$6 billion for vaccine procurement. Another HK$500 million will be used to clean streets.

The fund has also set aside HK$13.2 billion to create temporary jobs in the public and private sectors amid fears of pandemic-driven unemployment.

5. Back in black – then back to red again

The government expects to return to the black after running a deficit last year, with a surplus of HK$18.8 billion at the end of 2021-22. The projection was a reversal from an earlier forecast of a HK$101.6 billion deficit for the financial year.

However, 2022-23 is expected to bring a HK$56 billion deficit – equivalent to 1.9 per cent of the city’s GDP – in the wake of the government’s massive spending.

The city’s fiscal reserves are estimated to stand at about HK$940 billion at the end of the current term, and will gradually rebound to more than HK$1 trillion – equivalent to 16 months of government expenditures – over a five‑year period.

6. Landlords, multinationals set to feel pinch

To increase revenue, Chan suggested revising the property tax system for the first time since 1995. Starting from 2023-24, owners of residential properties would be able to apply for tax rebates – where applicable – for one self-occupied property only, rather than multiple ones. The arrangement would save the government HK$3.1 billion on rate concessions.

A progressive system would also be introduced by 2024-2025 under which tax rates would rise along with properties’ rateable value – calculated as 5 per cent of a home’s annual rental value. Properties with a rateable value of less than HK$550,000 would be taxed at the current rate of 5 per cent of that value. The tax rate would jump to 8 per cent for the next HK$250,000, and to 12 per cent for any amount over HK$800,000.

Chan expected around 42,000 properties would be affected, and that government revenue would increase by HK$760 million a year.

Hong Kong throws SMEs a rental relief lifeline as Covid-19 fifth wave bites

Multinational corporations, meanwhile, will face a new global minimum tax rate of 15 per cent under the Organisation for Economic Cooperation and Development’s international tax reform. The government also plans to introduce a domestic minimum top-up tax on these corporations from 2024-25 expected to bring in HK$15 billion a year.

7. Investing in the future

The budget also outlined various investments aimed at driving economic growth, focusing on several technology-related fields. Some HK$10 billion is earmarked for developing life science technology, improving hardware, upping research manpower and conducting clinical trials. A “InnoLife Healthtech Hub” will be set up to bring together 24 laboratories to focus on research in biomedicine, big data and artificial intelligence.