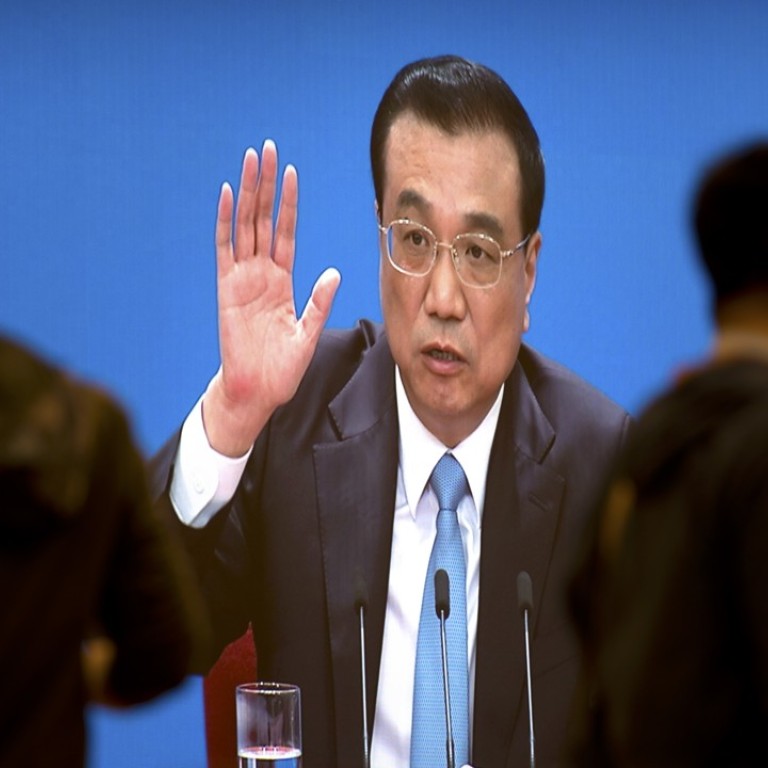

China will push ahead ‘resolutely’ with financial sector fight, says Li Keqiang

Premier says regulators have ‘lanced the boil’ of illegal market activities and will continue to tackle them

China said it will continue to “resolutely” tackle financial irregularities, after several officials and tycoons were punished last year in a crackdown on market manipulators and fraud.

“Some unlawful and [risky] conduct has been making waves in China’s financial sector,” Premier Li Keqiang said at a press briefing wrapping up the National People’s Congress on Tuesday.

China’s regulators had been working “decisively” to prevent financial risk from spreading, Li said, and had “lanced the boil” of illegal market activities to avoid moral hazard. “If similar problems emerge in the future, we will continue to tackle them resolutely,” he said.

The financial sector has expanded rapidly since China entered the World Trade Organisation at the end of 2001. From 2001 to 2016, banking sector assets grew by 12 times to reach over 224 trillion yuan (US$35.34 trillion), while those of the insurance and securities sectors also jumped – to 15 trillion yuan and 4.37 trillion yuan, respectively. But the financial market has also become a hotbed for rent-seeking, price manipulation, corruption and rampant irregularities.

In the summer of 2015, a stock market rout wiped about US$5 trillion off the value of mainland shares, sending shock waves around the world. It prompted a crackdown on financial irregularities, particularly cases where tycoons colluded with officials to take advantage of loopholes in the fragmented regulatory system.

Since then, President Xi Jinping has made controlling financial risk a top priority. Beijing has said it is one of China’s three big “battles” for the three years to 2020.

“The message is clear that China will continue to go after bad guys in the financial sector,” said Hu Xingdou, an independent political economist in Beijing. “The punishment is long overdue, as vested interests have become so strong, which hurts China’s economy and undermines people’s confidence in China’s political system.”

In the aftermath of the 2015 market meltdown, two high-ranking officials from the China Securities Regulatory Commission were put under investigation on suspicion of colluding with speculators to undermine the government’s efforts to stabilise the situation.

Similarly, Xiang Junbo was sacked last year as chairman of the China Insurance Regulatory Commission and placed under criminal investigation, accused of issuing operating licences to favoured insurers.

Last month, the insurance regulator seized control of Anbang Insurance Group and charged its former chairman, Wu Xiaohui, with “fundraising by fraud” – a serious charge that could result in life imprisonment. Wu is known for his ties to the country’s most powerful families, including his marriage to a granddaughter of late paramount leader Deng Xiaoping.

Early last year, Xu Xiang, a hedge fund manager with Zexi Investment, was sentenced to 5½ years in prison and fined a record 11 billion yuan for his role in manipulating the stock market in 2015.

Li said China had the capacity to prevent systemic financial risk, as it has over 20 trillion yuan of capital in reserve, deposited by commercial lenders in the central bank system, and plenty of revenues in the government coffers.

“We will merge the banking and insurance regulators under the latest government reorganisation scheme,” he said, adding the move was aimed at streamlining the system.

During the legislative session last week, the central government announced that the job of drafting regulatory frameworks would be shifted to the central bank from the banking and insurance regulators, after the latter two were merged.