Soaring prices hit Chinese factories and foreign buyers amid pollution crackdown

Mood is sanguine at Canton Fair but small manufacturers are worried about environmental regulations pushing up costs, and currency fluctuations

Chinese exporters at the country’s biggest trade fair are more optimistic about global demand now than six months ago but Beijing’s crackdown on pollution is ramping up costs and product prices, hurting smaller factories and foreign buyers.

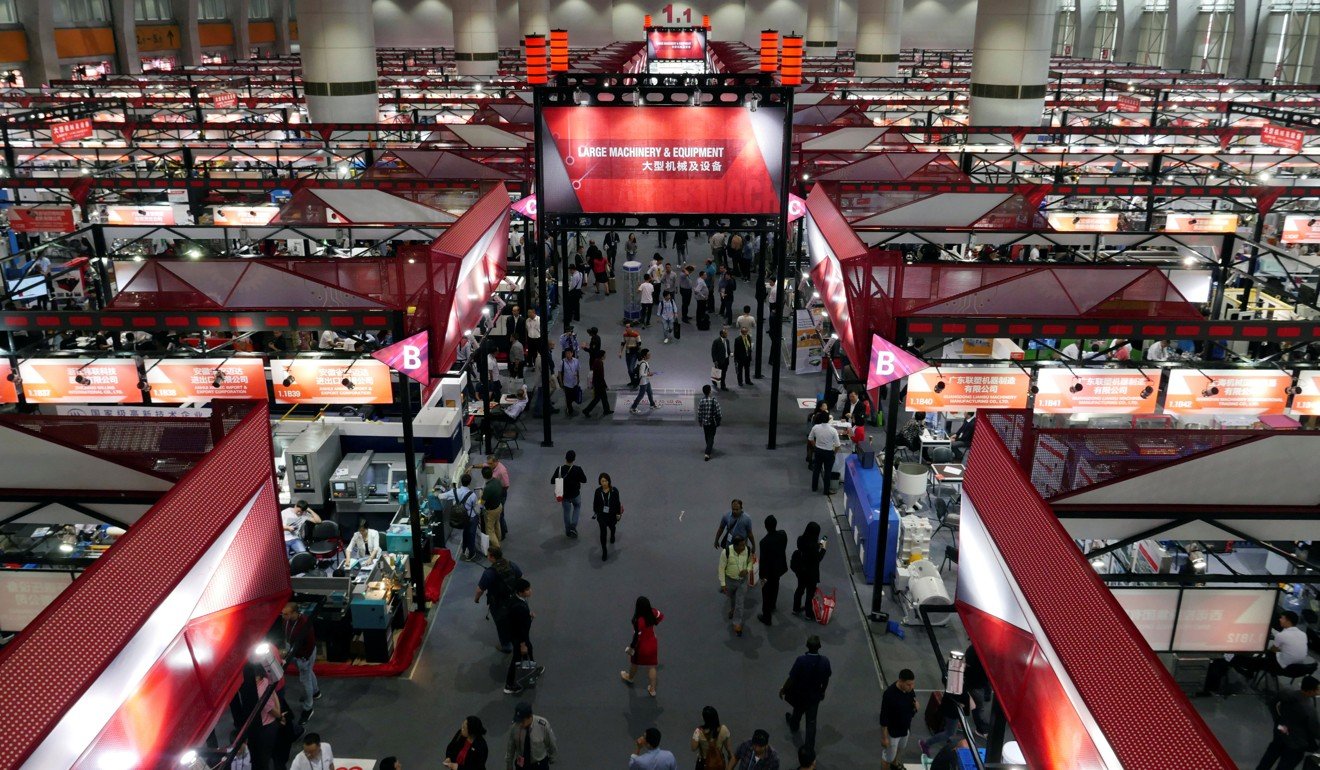

At the Canton Fair, where some 25,000 manufacturers are showcasing products from industrial engines to egg-cracking machines, the mood is sanguine. The world’s second-largest economy has defied expectations for a slowdown this year and import and export growth in September suggests factory activity remains in high gear.

In a survey of 102 exporters at the Guangzhou-based trade fair, 77 per cent of the mostly small- to medium-sized Chinese manufacturers expect orders to increase next year, compared with 70 per cent during the previous event in April.

But many manufacturers, especially smaller ones, complained about currency fluctuations and China’s stepped up anti-pollution drive pushing up costs as firms scramble to invest in new equipment or costly processes to meet more stringent emissions standards.

“The environmental regulations are hitting everyone. I’d say 30 per cent of factories are affected,” said Lynn Chen, a director of Masda, a Pearl River Delta manufacturer of antennas with around 20 million yuan (US$3 million) in sales annually.

Larger factories were weathering the anti-pollution blitz better but many small factories were being forced out of business, including small aluminium tube makers in eastern Zhejiang province, Chen said, noting that the costs of sourcing such components for antennas had risen 20 per cent.

Price rallies across the commodities complex have accelerated in recent months as the government has ramped up environmental inspections and factories prepare for the most stringent ever smog-busting measures across the north this winter. Some 28 cities have been ordered to slash output of heavy industry from aluminium and steel to cement for four months from November 15.

Price of clean air

David Li of Guangzhou Light Holdings, which makes karaoke speakers with pulsing disco lights, said plants with metal plating, dyeing or spray painting processes had been badly hit, raising production costs by 5 to 10 per cent.

A virtual ban on waste paper imports on environmental grounds was also creating a shortage of generic cardboard packaging, driving up paper prices more than 60 per cent in some cases, four exporters said.

“The changes are good, but they’re being pushed through too fast,” said Li.

Of the 102 exporters polled by Reuters, production cost was the biggest concern.

While online sourcing has partially supplanted marquee trade events such as the Canton Fair, which began in 1957, the event continues to draw tens of thousands of Chinese factories and foreign buyers, making it a useful barometer of China trade.

Some foreign businessmen said they were shocked by the jump in prices for some products.

“It’s really scary. How could the price change so much?” said Lagos-based Maxwell Akabuogu, who has cut the number of containers he sends monthly to Nigeria from 12 to three, with prices of lead batteries, his staple product, having surged 30 per cent over the past four months.

“I’m starting to buy from South Korea now. It’s more reliable and the price is steady,” he said.

Venee Wen, a regional sales manager for the Guangzhou Tiger Head Battery Group, that makes the popular “555” brand, said lead battery prices had jumped 20 to 30 per cent since April given a surge in costs for the base metal.

“China’s long-term policies on the environment are good but there is a short-term impact ... the bad [polluting] companies have died,” she said. “The buyers will have to get used to these prices. They won’t go back to the previous levels.”

During the summer, zinc and lead prices in Shanghai rallied with scores of local mines shutting down for long stints during anti-pollution inspections. Winter production curbs have also stoked record buying of raw materials from abroad.

Currency pain

Forty-four per cent of firms surveyed said the yuan’s 5 per cent rise against the dollar this year had hurt their business “significantly”, while nearly 50 per cent said it was hurting them “slightly”.

Forty-three per cent see a further appreciation of the yuan by 2 to 5 per cent in the coming 12 months.

Concerns about a trade war between China and the United States under President Donald Trump have also eased, with 30 per cent seeing such a possibility in the current poll, compared with 40 per cent in April.

“Trump is a businessman,” Liu Linxia, an LED TV maker, said. “He’ll make some noise, but not fight.”

Many shrugged off geopolitical tensions in North Korea escalating into a possible conflict, with only one in five exporters polled concerned about this risk.