What’s ahead for the new EU commission as it addresses the imbalances in China ties

- Mathieu Duchâtel writes that continuity should be expected from the new team under Ursula Von der Leyen on a defensive China policy agenda, focused on rebalancing the trade and investment relationship

A new EU Commission enters in function today. The outgoing Juncker commission has to be credited for recalibrating the China policy of the European Union. It is now standard EU language to define China as a “partner, a strategic competitor and a systemic rival”.

Before 2014, the centre of gravity of Europe’s China policy was how to expand bilateral cooperation under the framework of the comprehensive strategic partnership.

Engagement is still the basic policy guideline for handling relations with China, but the European priority has shifted to address the deep asymmetries and imbalances in the EU-China relationship, including through the construction of a toolbox of defensive measures.

This is because, to paraphrase the June 2019 official EU strategic outlook on China, the “balance of challenges and opportunities presented by China has shifted”.

Even if engagement remains its guiding principle, the China policy of the new EU Commission will be dominated by the management of bilateral disagreements

Continuity should be expected from the new team under Ursula Von der Leyen on a defensive China policy agenda, by lack of better options, with a strong focus on rebalancing the trade and investment relationship.

Overall, China policy will be high on the Commission’s agenda, as it intersects with several of the institution’s larger priorities: the adaptation of Europe to the new digital age; defence of a rules-based international order; promotion of an open and fair-trade agenda; external promotion of the highest standards of climate, environmental and labour protection; and determining how to support innovation in Europe in the face of international competition.

Indeed, 2020 has the potential to be critical for the EU-China relationship, in at least two areas: the deployment of 5G infrastructure in Europe and the evolution of the regulatory environment for foreign investment in Europe and in China.

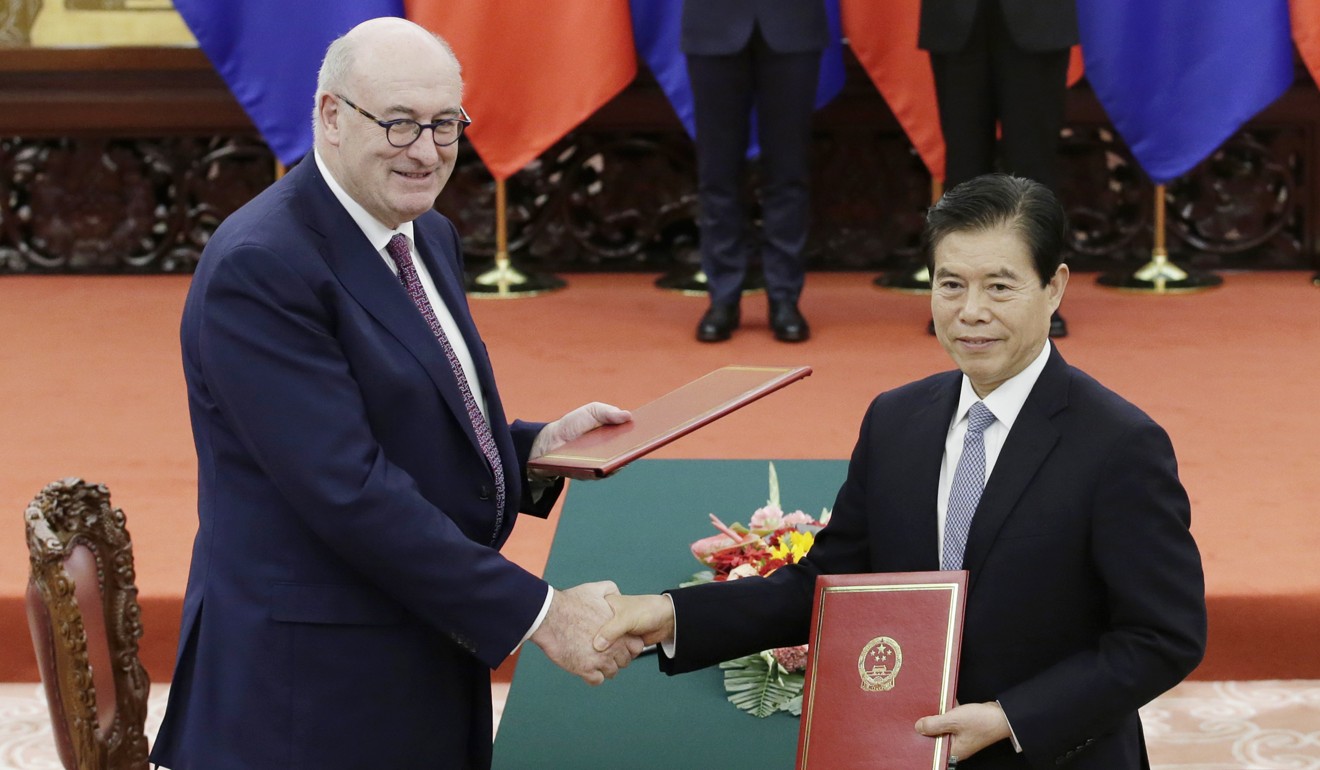

The negotiation of a Comprehensive Agreement on Investment with China will top the agenda of Trade Commissioner Phil Hogan and the Directorate-General for Trade. Optimists expect a document to be concluded under the German presidency of the EU Council, during the second semester of 2020.

Pessimists argue that China does not show any serious intention to accept concessions and has its full attention captured by the United States. Both sides seek to influence the regulatory environment for their companies, but with very different stakes in the negotiation.

The EU seeks to address asymmetries and gain market access, two goals that have remained elusive for years. But Chinese companies enjoy a favourable status quo: a Europe completely open for business.

It is only now with the status quo beginning to erode and China facing huge pressure from the United States that Beijing has an incentive to negotiate, to avoid a loss rather than to secure a gain.

2020 will see the entry into force of the EU investment screening mechanism. The EU is not a sovereign state with a strong executive power. Hence, observers should not expect the new system to give the Commission the right to block transactions or impose remedies on foreign investors when a planned operation poses a threat to member states’ national security or endangers public safety.

China set to make new offer to EU over investment deal

The new system is nevertheless a game-changer in at least two ways.

First, the Commission and member states will be able to use a solid information-sharing system that will provide long-needed visibility on problematic transactions. This will help refine the controls over transfers of technology. Second, the politics matter enormously. The Commission promotes convergence and best practices across Europe.

As a result, overall, member states have become more aware of the security implications of foreign investment, especially when they target critical technology and critical infrastructure.

This means scrutiny at various stages of the decision-making process before approval – including media scrutiny. The ultimate decision will stay with member states, but there is now a European process, which the Commission and other member states can formally influence.

As a result, Chinese acquisitions in Europe will be the subject of much more attention. Transactions that in the past led to technology transfers or loss of control over strategic assets may be handled differently.

EU’s China chief urges Hong Kong and Beijing leaders to heed elections

A similar approach to promote European convergence is at play in the area of 5G. Several member states do not yet have the institutional capacity to apprehend and manage the security implications of building and operating a 5G network, and an EU process is very significant in that regard.

The question is reaching the critical moment in Brussels and in many European capitals.

The EU has already synthesised the evaluations of all member states in a risk assessment paper released last October, which stresses the notion of “trusted vendor”, mostly defined in technical terms.

In a second phase this coming December, the EU will announce a European security toolkit. This will be a mix of technical measures to protect the telecommunication networks from intrusion and sabotage, audits and certifications. The question is how far the logic of “trusted vendor” will be pushed and the extent to which this will constrain Huawei’s market share in Europe.

A third area where the EU may start playing defence is public procurement. Estimated at €3,4 trillion (US$3.7 trillion), the EU’s public procurement market is completely open to all bidders.

China’s vision of a digital highway into Europe will raise hackles

The asymmetry with the Chinese market, dominated by state-owned enterprises, couldn’t be starker. Can the European Commission restart the intra-European negotiation of a public procurement instrument?

The negotiation failed in the past given the diverging approaches of member states, but the environment and the mood have both changed. During his hearing before the European Parliament, Commissioner Phil Hogan mentioned the adoption of the instrument as a priority.

With such an instrument, the EU would finally be in position to enforce the principle of reciprocal market access on public procurement transactions.

On these issues, EU unity is not a given, but the trend is greater convergence. The EU’s defensive agenda responds to asymmetries in the relationship, but it also reflects a shrinking of European ambitions to engage China as a strategic partner on international security issues.

Long a stated objective of the EU, it has not survived a series of cruel disillusions, as strong differences of approach and sometimes diverging interests set the two sides apart on many international crises, from Afghanistan to Ukraine and from the South China Sea to Syria.

EU’s carbon border tax will dent climate change efforts, China says

And when they agree, this is not necessarily consequential. This is the lesson learned from the Joint Comprehensive Plan of Action with Iran. The withdrawal of the US from the agreement underlines the strategic powerlessness of EU-China alignment, as symbolised by the decision of China National Petroleum Corp and Total to leave the South Pars gas project despite political efforts to protect European and Chinese business interests with Iran.

In short, even if engagement remains its guiding principle, the China policy of the new EU Commission will be dominated by the management of bilateral disagreements; and if China remains inflexible, its success will only be measured by the effectiveness of the defensive measures the EU will adopt internally.

Mathieu Duchâtel is director of the Asia programme at Institut Montaigne