- Fake-meat pioneers Beyond Meat and Impossible Foods had what looked like a game-changing product. Now it appears to have been little more than a fad

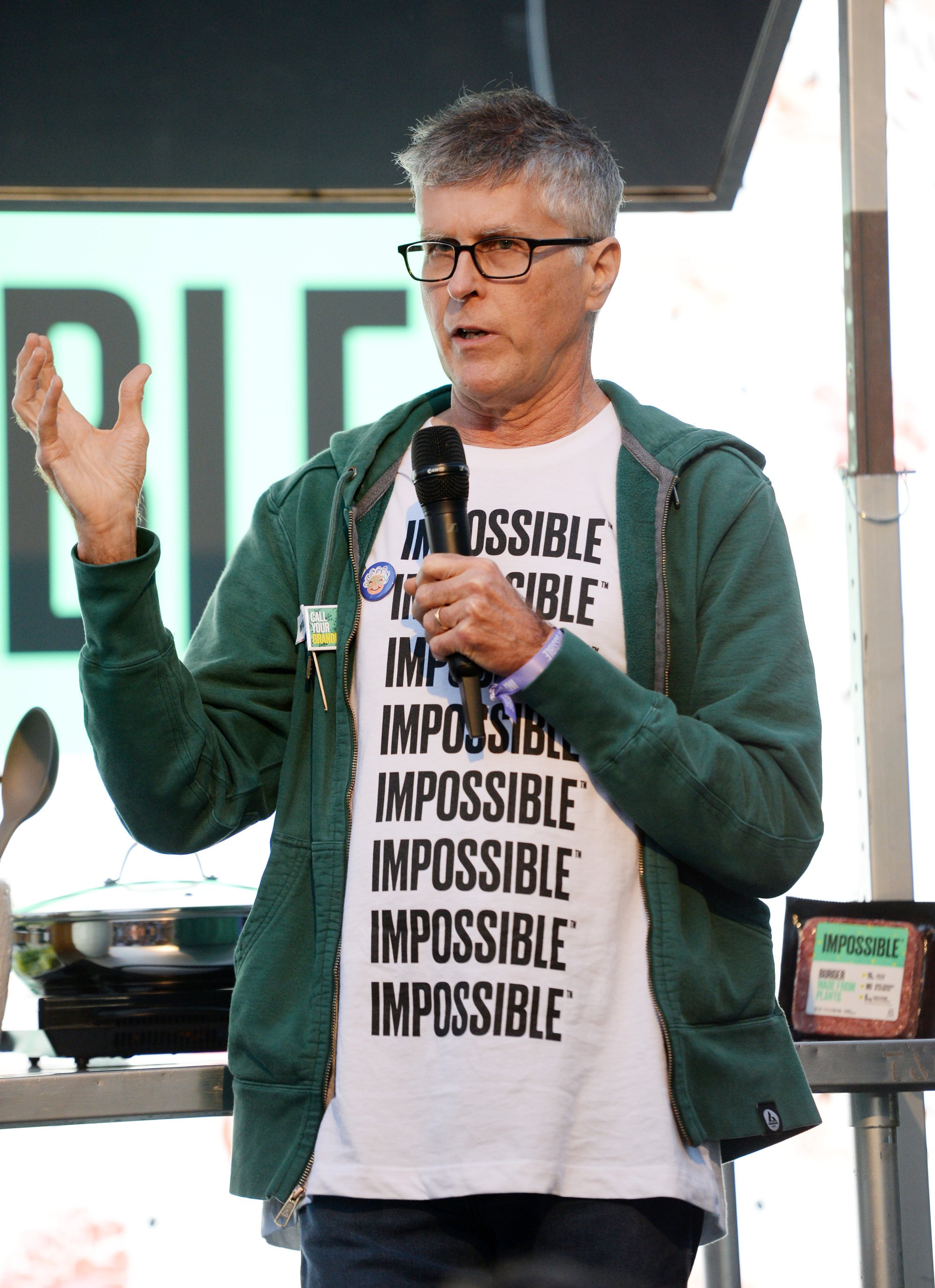

Ever since founding Beyond Meat in 2009 with the idea of making meat without animals, Ethan Brown has been giving the equivalent of one extremely long TED Talk.

In 2013, he took the stage at the Wired Business Conference in New York, explaining that the world had a very real greenhouse gas-emitting meat problem and that venture capitalists could make a bigger impact investing in fake meat than in solar energy.

At the annual Ideacity gathering three years later in Toronto in Canada, he said his goal was to replicate the “blueprint of meat”.

Just as technology had turned the horse-drawn carriage obsolete, he told the crowd at The New York Times’ climate conference this past autumn, his system of breaking down plants would transform the protein at the centre of the plate. “This,” he said, “is something that I feel is inevitable.”

Bodybuilder ditched whey protein for plant-based substitutes, feels fitter

Along with the venture capitalists came investors from every corner of culture – actor Leonardo DiCaprio, the Humane Society of the United States and former McDonald’s CEO Don Thompson.

Even Tyson Foods, the biggest maker of real meat in the US, invested and then invested again, catapulting the young California-based start-up to a US$1.3 billion valuation by 2018.

Before Impossible had sold a single burger, the company managed to raise US$183 million.

Patrick also worked the circuit, including at an actual TED Talk in 2015. Speaking in slightly more apocalyptic terms than Ethan, Patrick referred to the “ongoing wildlife holocaust” caused by the world’s insatiable demand for meat, while an assistant sizzled an Impossible Burger onstage beside him.

“I know it sounds insane to replace a deeply entrenched, trillion-dollar-a-year global industry,” he said, “but it has to be done.”

‘Fitter than ever’: she feels benefits of a whole food, plant-based diet

Four years later, when The New Yorker profiled Impossible, Pat predicted his company would “take a double-digit portion of the beef market” by 2024 before sending it into a “death spiral”. Next, he would target “the pork industry and the chicken industry and say, ‘You’re next!’ and they’ll go bankrupt even faster”.

In the US, supermarket sales of refrigerated plant-based meat plummeted 14 per cent by volume for the 52 weeks to December 4, 2022, according to retail data company IRI. Orders of plant-based burgers at restaurants and other food-service outlets for the 12 months to last November were down nine per cent from three years earlier, according to market researcher The NPD Group.

Beyond lost sales in almost every channel last quarter. Over the past year, it has laid off more than 20 per cent of its workforce, lost more than half of its top managers and halted projects including vegan hot dogs and the next alt-protein frontier of cell-cultured meat, according to people with knowledge of the matter, who asked not to be named discussing private information about the company.

While an index of packaged-food companies on the S&P 500 was up about four per cent from a year ago, as of January 7, Beyond’s stock price is now hovering around US$17, down about 71 per cent from a year earlier and 93 per cent from its peak in the summer of 2019.

They are doing their very best today to suggest that our process is somehow unhealthy or that our products are full of chemicals. These things are not true.Ethan Brown, Beyond Meat CEO

Impossible, meanwhile, is faring better – but Patrick is out of the company. Last April, he stepped down to chief visionary officer, replaced as CEO by Peter McGuinness, the former chief operating officer of yogurt maker Chobani, before taking a leave of absence.

Under McGuinness, Impossible has spun up new products such as animal-shaped faux chicken nuggets and blitzed supermarkets, leading to more than 50 per cent retail sales growth in the US in 2022.

While it has added restaurant partners, some of its long-standing ones are finding consumer excitement has either hit a wall or is declining. Shares of Impossible, a private company, are currently trading at around US$12, says Prab Rattan, head of capital markets at Hiive, a marketplace for private stock trading. That is about half the price during its last fundraising round, based on data from venture capital company PitchBook.

Plant-based meat’s most reliable enthusiasts at this point are the original veggie burger fans, vegans and vegetarians. The all-important meat eaters do partake, but at a lower frequency. “They’re just not that into it,” says Chris DuBois, head of IRI’s protein practice.

How did an industry with so much riding on it – backed by so much money – fizzle out? The companies declined to make Ethan and Patrick available, but at that New York Times climate conference last October, Ethan pointed his finger at the actual meat industry for causing fake meat’s headwinds.

“They are doing their very best today to suggest that our process is somehow unhealthy or that our products are full of chemicals,” he said. “These things are not true.”

Swedish company develops plant-based ‘human meat burger’

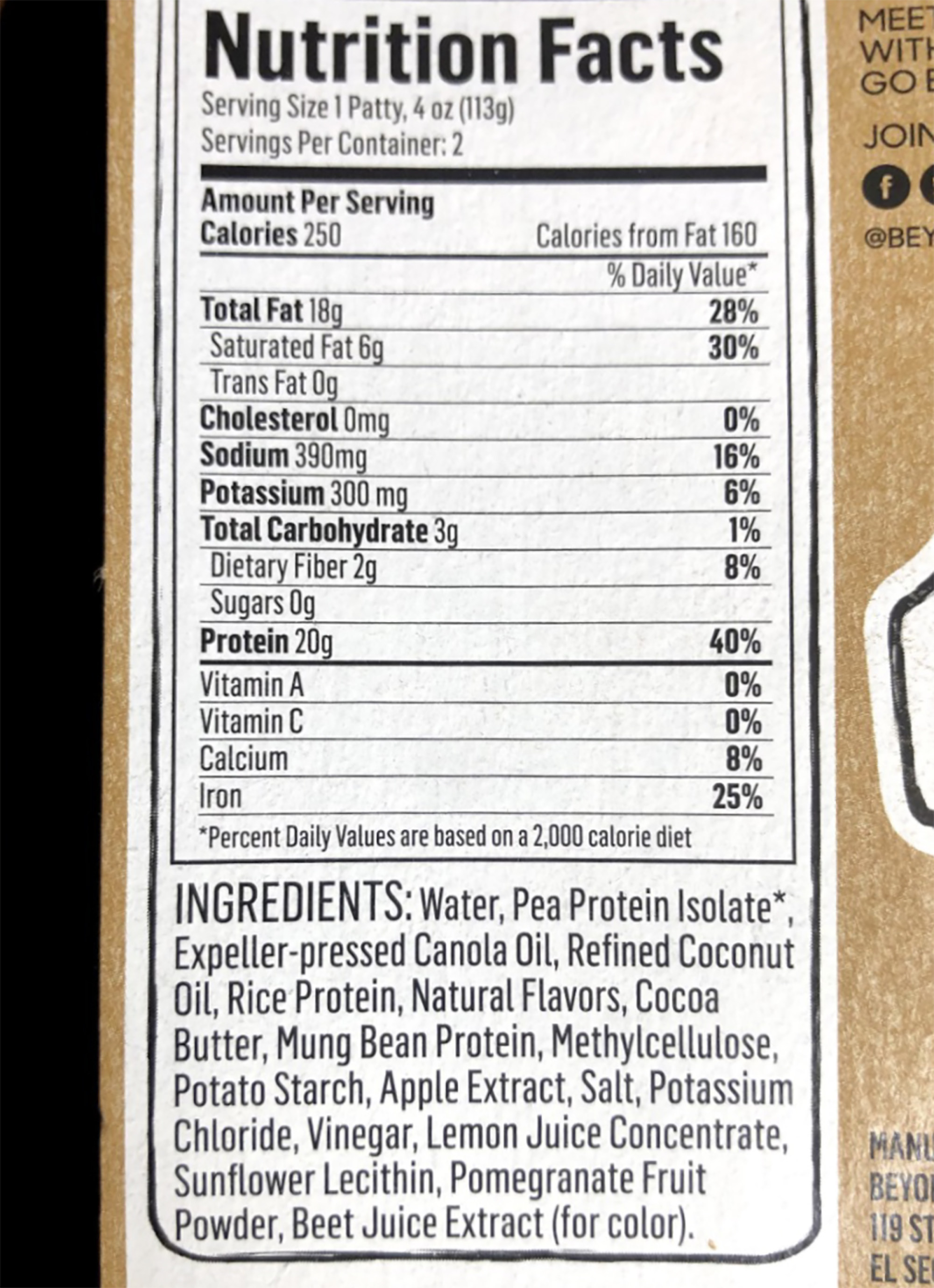

Whatever critiques the meat industry is throwing are the same ones plenty of consumers are figuring out for themselves. Many meat eaters initially excited by fake meat, who did not mind the not-quite-there taste or texture, eventually took a closer look at the ingredient list and could not figure out whether they were actually trading up.

Meatless meat, it turns out, seems less a world-changing innovation than another food trend whose novelty is wearing thin.

“Before, we were seeing this incredible growth rate. But when you lose that momentum, you lose your certainty around how big plant-based meats can be,” says Thomas George, portfolio manager at investment research company Grizzle, who in 2019 predicted that plant-based meat could overtake 10 per cent of the meat industry in 10 years if it could match meat’s prices.

“The opportunity for this category,” he says now, “is more murky.”

Before Beyond Meat unveiled the Beyond Burger, there was the Beast. When Ethan introduced the frozen patty in 2015, the company called it a “protein shake on a bun”.

Convenience chain Lawson to sell heat-and-eat boxes featuring Beyond Meat

Although he ended up ditching it, the Beast’s health claims, such as high levels of protein and zero gluten or soy, remained front and centre on its packaging. When asked, Patrick defended the health cred of Impossible’s product against beef, though he preferred to talk about replacing animal agriculture by 2035.

The Game Changers followed world-class vegan athletes, with cameos by doctors, scientists and even Arnold Schwarzenegger, who, before he became mostly vegan, told Sylvester Stallone that he “hit like a vegetarian”.

Veganism, according to the film, would make a person not only healthier but also stronger, with better endurance and even longer, harder erections.

Ethan added the film to his arsenal. “If you look at movies like The Game Changers, etc,” he said in 2019, “you can affect even individual day performance, from a student-athlete, for example, through the consumption of our products over animal protein.”

How Asia’s first plant-based butcher is winning over Singaporeans

The Beyond Burger was originally sold in supermarkets while Impossible went with celebrity chefs such as David Chang. By the end of 2019, Carl’s Jr, Dunkin’ and White Castle were all selling some Beyond or Impossible product or other – and Burger King had launched the Impossible Whopper nationwide in the US.

The food giants did not want to get left behind either. Tyson had shown an interest in buying Beyond, according to former Beyond board member Greg Bohlen. When that did not pan out, the meat company announced plans for its own plant-based “billion-dollar brand”. Tyson declined to comment.

Nestlé introduced an Awesome Burger and Conagra Brands’ CEO said it would create “the next generation of beefless burger”.

Within months of Beyond’s IPO, one-time fan and whole-foods maven Mark Bittman criticised the fake meat products for their “hyper-processing”.

Chipotle Mexican Grill’s CEO, Brian Niccol, said they did not fit with the fast-casual chain’s “food with integrity” mantra. Even John Mackey, co-founder of Whole Foods Market – the grocer that had been instrumental in introducing the category in the US – went on the record calling plant-based meat “super, highly processed foods”.

Nobody should be under the illusion that these are health foodsDr Michael Greger, author of How Not to Die

In 2020, half of Americans thought faux meats were healthy; now 38 per cent think so, a recent report from Citi Global Insights shows.

Dr David Katz, founding director of Yale University’s Prevention Research Centre, who appears in The Game Changers, says the Beyond Burger and its ilk are “ultra-processed” – made from processed ingredients such as pea protein, potato starch and potassium chloride.

When comparing them with fast-food burgers, he cites the environmental and animal welfare advantages but says that any health benefits are still unclear. “At worst,” he says, “it’s a lateral move.”

A Beyond Meat representative said there are “well-accepted health benefits of plant-based meat” and pointed out two health professionals: Stanford researcher Christopher Gardner, who has received funding from Beyond Meat, conducted a small study that pointed to improvements in weight and cholesterol.

He says the health benefits he identified, however, have yet to be replicated. “You can’t answer a question with only one study,” Gardner says.

And Dr Michael Greger, author of How Not to Die (2015), says that fake meat is a better choice than a fast-food burger, but that does not make it good for you. “Nobody should be under the illusion that these are health foods,” he says.

Chinese plant-based meat start-up takes on Beyond Meat and Omnipork

Nowhere is this more obvious than when you discover that a key ingredient in Beyond Meat has its origins in Dippin’ Dots, the tiny beads of ice cream frozen with liquid nitrogen, available in flavours including banana split and candyfloss.

Beyond started working with Dippin’ Dots in 2019. The Dots business was sold in June 2022, but Beyond still works with Scott Fischer, its former CEO, through his company Cryogenic Processors. Beyond buys fats such as expeller-pressed canola oil and refined coconut oil, which Fischer processes into “little pellets or cryogenically frozen balls of fats”, he says.

Cryogenic Processors sends the fatty balls back to Beyond to mix with water, rice protein, cocoa butter, methyl cellulose and more than a dozen other ingredients found in the Beyond Burger.

The white globules are meant to give the burgers a meaty juiciness, but plant-based fats can also emit an off-putting smell when some of the products are cooked, says Tom Mastrobuoni, who led the second Tyson investment in Beyond and is now chief investment officer at the food-tech-focused Big Idea Ventures.

Commenters online have compared the odour of Beyond’s raw plant meat to that of cat food, and one message board poster said he had to ventilate his kitchen to clear the air after cooking it.

“If any other food smelled that way, I would throw it out,” says Jeremy Sklarsky, a former Beyond customer who tried the products out of health and environmental concerns before going back to beef.

Why plant-based fast food isn’t any healthier than eating meat

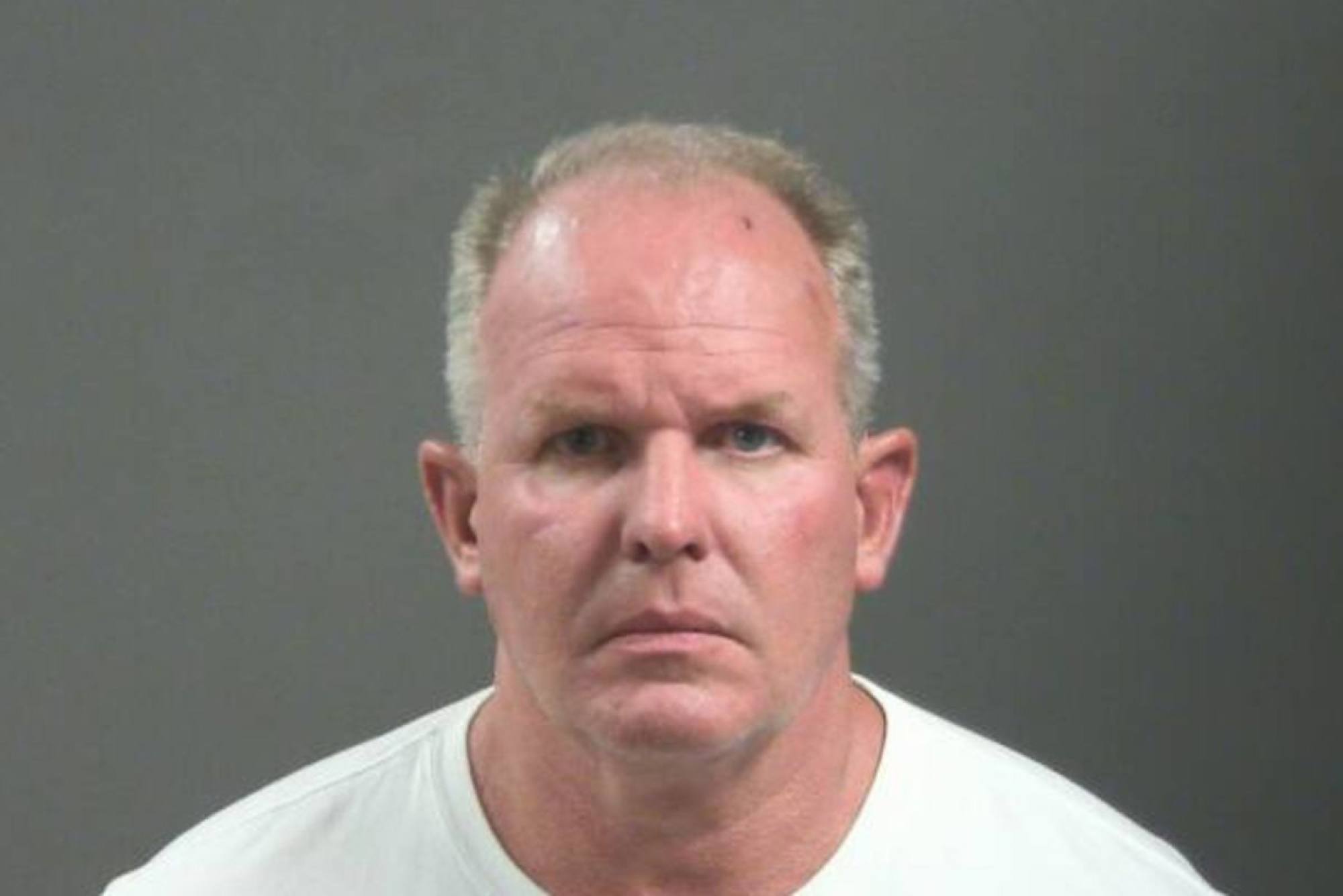

Last September, Beyond Meat chief operating officer Doug Ramsey was arrested in Arkansas for allegedly biting someone’s nose in an altercation after a college-football game. Ramsey, a former Tyson executive, was one of the meat industry veterans Ethan had wooed in 2021 to help Beyond expand.

By mid-October 2022, Ramsey, along with the company’s chief financial officer, chief growth officer and chief supply chain officer, was gone.

The love affair between Beyond and the fast-food giants has faded, too. Dunkin’ – once the company’s biggest-name partner – pulled the faux sausages in its breakfast sandwiches from almost all the menus in the US in 2021.

Beyond’s delayed plant-based chicken tenders launch had no big-name chains in sight. Taco Bell tested Beyond’s carne asada, but in December its CEO, Mark King, told Axios the reviews were “mixed” and a national roll-out in the US is not likely any time soon.

Meanwhile, photos and documents from Beyond’s plant in Pennsylvania – where both the KFC nuggets and Pizza Hut pepperoni were partially manufactured – revealed that listeria and foreign materials such as wood and string had been showing up in products made there as late as May 2022.

A spokesperson for Beyond Meat said at the time that the company’s food-safety protocols “go above and beyond industry and regulatory standards”.

Beyond Meat’s meatless patties are first to hit China’s grocery stores

Beyond also trialled its burger at about 600 US locations with McDonald’s, its most important customer, with little to show for it. For a brief moment in April, it looked like the McPlant meatless burger would stay for good.

Fast Company misreported that the McPlant would become a permanent menu item, sending Beyond’s stock price up as much as 34 per cent – until McDonald’s disputed the news, causing shares to fall just as quickly.

“Negative PR around a senior member of management with key MCD relationships likely hurts whatever slim chances may have remained,” Piper Sandler’s Michael Lavery wrote in a note.

McDonald’s still sells the McPlant internationally, but it has not confirmed results of the US test or future plans.

Impossible, meanwhile, is discovering that upending animal agriculture is difficult. Burger King has added another Impossible Burger to its mix, but after trying the company’s faux chicken nuggets, a chicken sandwich and sausage patties, it did not put any in its regular line-up.

Plenty of vegetarians would prefer a veggie burger made of actual vegetables, and definitely not one that “bleeds”

FAT Brands restaurants are selling a steady million Impossible Burgers a year – which is good, but not as good as beef, whose sales are climbing. At Bareburger, also an Impossible early adopter, the burger’s sales went from “astronomical” to about six per cent of all burgers and sandwiches in 2021 to four per cent in 2022, says Euripides Pelekanos, the chain’s CEO.

“The fanfare has definitely subsided,” he says. The price of the burger – more than that of the beef, elk and black bean versions – does not help.

Patrick’s replacement at Impossible, McGuinness, an ad industry veteran who left yogurt maker Chobani last year, says he has new growth plans for the California-based start-up. “I don’t want to talk about the category declining – it doesn’t exist,” he says, even though Impossible has been trying to lead it for the better part of the past decade.

In October, he laid off six per cent of the staff as part of a broader restructuring, telling employees the company was focused on its “R&D and innovation pipeline”, and, according to a report last month, was preparing to cut about 20 per cent of its workforce.

In 2019, New York’s Javits Center hosted the first Plant Based World Expo. Amid hawkers of seitan corned beef and pea-and-tomato-based chorizo, the real excitement was Beyond. Fresh off its IPO, the company’s executive chair, Seth Goldman, was a keynote speaker.

Impossible Foods, Beyond Meat eye growth in Asian plant-based foods market

“I wish I had invested in them,” Andy Levitt, founder of vegan meal-kit start-up Purple Carrot, said at the time. When Levitt started his company, in 2014, vegans were the “tattooed girl with Birkenstocks in Vermont”, he said. Beyond’s products had catapulted an entire generation of start-ups, becoming the “gateway drug to plant-based foods”.

The 2022 Expo felt a lot more like a regular old trade show. There were no signs of Beyond, unless it was from an exhibitor answering a question to differentiate itself from the one-time star.

Booth after booth showcased products such as Shark Tank-backed faux deli slices and textured soy protein jerky, but few were good enough to go back for seconds, many more so unpalatable that this meat-eschewing reporter spat them out.

By far the best-tasting food at the event was in the Italian Pavilion, where chefs served cheeseless vegetable pizzas and pasta puttanesca sans the anchovies – no imitation animal protein to be found. Asked what he was doing at the fake-meat show, Italian chef and restaurateur Fabrizio Facchini was taken aback.

“We also have a lot of plant-based,” he said, relying on the literal meaning of the phrase more than on the marketing term. “We don’t use cheese on everything.”

Beyond Meat’s current market capitalisation is about US$1 billion – down from its peak of more than US$14 billion. Bringing costs down is the company’s priority as it pledges to finally become cash-flow positive in the second half of this year and tries to keep up its dwindling cash reserves.

China’s plant-based meat makers look to take on the world

In the company’s November earnings call, Ethan talked up another limited-time offer with Panda Express and the company’s 2022 food award from People magazine. The analysts, though, peppered him with questions about high inventory levels and why Beyond was making only ingredients instead of prepared meals.

Ethan blamed inflation and shifting consumer tastes as blips in his long-term mission. “I am certain that as we hit price parity with that, as the products become indistinguishable, as the climate situation worsens, as people get a clear sense of what the real health benefits are,” he said, “this conversion will happen.”

After Beyond, Impossible and their copycats spent years trying to seduce everyone away from meat, it appears their best customers are, well, the five per cent of the population who did not eat meat in the first place.

Kevin Lindgren, director of merchandising at food distributor Baldor Specialty Foods, in New York, says more restaurants are ordering plant-based burgers simply to make sure they have something to serve vegetarians “that’s not a salad or cauliflower”.

Alt-burgers’ continued expansion into restaurants is largely being propped up by establishments protecting themselves against this “veto vote” – the lone non-meat eater in a group of diners who can thwart a destination decision if there is not a suitable meatless option.

“It’s frozen, throw it in the freezer,” Lindgren says, summarising restaurants’ enthusiasm. But even that is not a sure shot. Plenty of vegetarians would prefer a veggie burger made of actual vegetables, and definitely not one that “bleeds”.

What's in a plant-based ‘meat’ burger and is it better than a beef patty?

Impossible is now venturing beyond the coasts of the US, where many have already moved on from fake meat, hoping to jump-start interest in the rest of the country. But when Impossible sausage was added to the menus of more than 600 Cracker Barrels last summer, the company quickly got a taste of this new customer base.

“YOU CAN TAKE MY PORK SAUSAGE WHEN YOU PRY IT FROM MY COLD, DEAD HANDS,” one of the thousands of angry commenters wrote when the Southern country-themed chain posted the new offering on Facebook.

Start-ups in this space have raked in US$2.6 billion in funding from investors including, once again, Gates and DiCaprio.

The category will have to overcome even bigger hurdles than plant-based meat, from the massive amount of energy required to make the products to exorbitant costs. But for boosters, its potential is already limitless.

“This,” Whole Foods co-founder Mackey said after investing in cellular start-up Upside Foods, “could change the world.”