SkyScanner vs Google Flights vs Kayak: cheap flight tickets war for search engine supremacy

Google is integrating its massive high-speed search engine with its other services, including Google Maps and Gmail, as it chases a large slice of the global travel search market. Rivals step up their game, seek growth in Asia

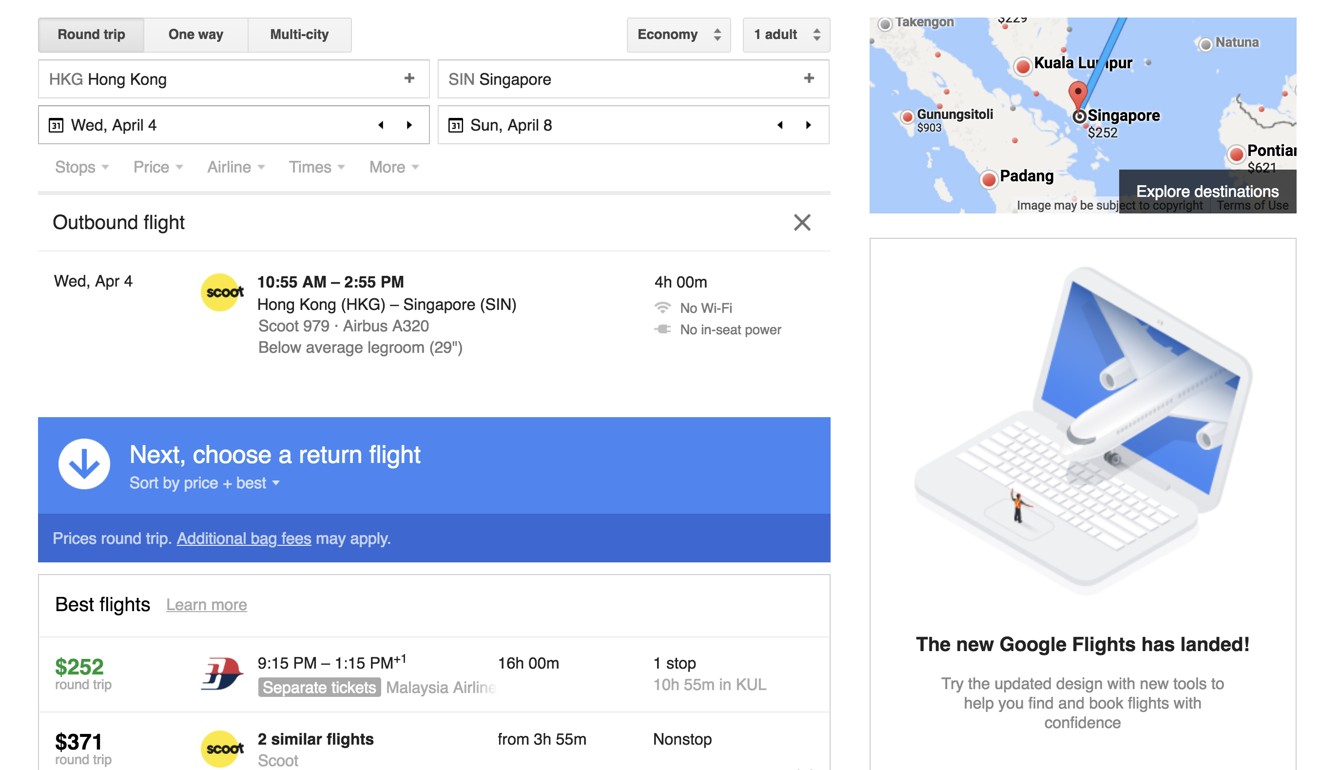

The new Google Flights has landed! That is the message many of you will have seen recently upon typing anything to do with flights into Google, as the mighty search engine continues its journey to becoming a major player in the travel industry.

In fact, it has more than doubled its unique monthly users from the first half of 2015 to the first half of 2017, according to travel industry market research company Phocuswright.

It offers tailor-made travel guides fully integrated with Google Maps (which itself already allows hotel bookings) and if you use Gmail, not only will it will pick up previous bookings and display them in its search results, it will also put them into a new app called Google Trips.

The travel apps that could make your next holiday cheaper, easier and better

Until now, the main markets for Google Flights, Kayak and Skyscanner have been the US and Europe. “One reason is that flight metasearch becomes much more useful when you have lots of airlines,” says Maggie Rauch, senior director for research at Phocuswright.

“That makes metasearch a less compelling option in China, Japan, Korea, Australia, and India, except for when it comes to international flights.” However, she adds, all three flight search companies are now going after travellers in Asia-Pacific markets. “The opportunity is changing as more Asian travellers go overseas,” she says.

Google is known for delivering results very quickly, and speed is something all metasearch platforms chase

It is not surprising that Google has the best technology out there. “Google is known for delivering results very quickly, and speed is something all metasearch platforms chase,” says Rauch. “But also key to users is how the information is delivered – how easy is it to compare flights and fares, and how do they enable to you to explore destinations or choose the best dates based on your needs and budget.”

INFOGRAPHIC: when is the best time to book a flight from Hong Kong?

Geography also plays a role. While Google is banned in China, Skyscanner is now owned by Chinese travel services provider Ctrip, the world’s second largest online travel agency.

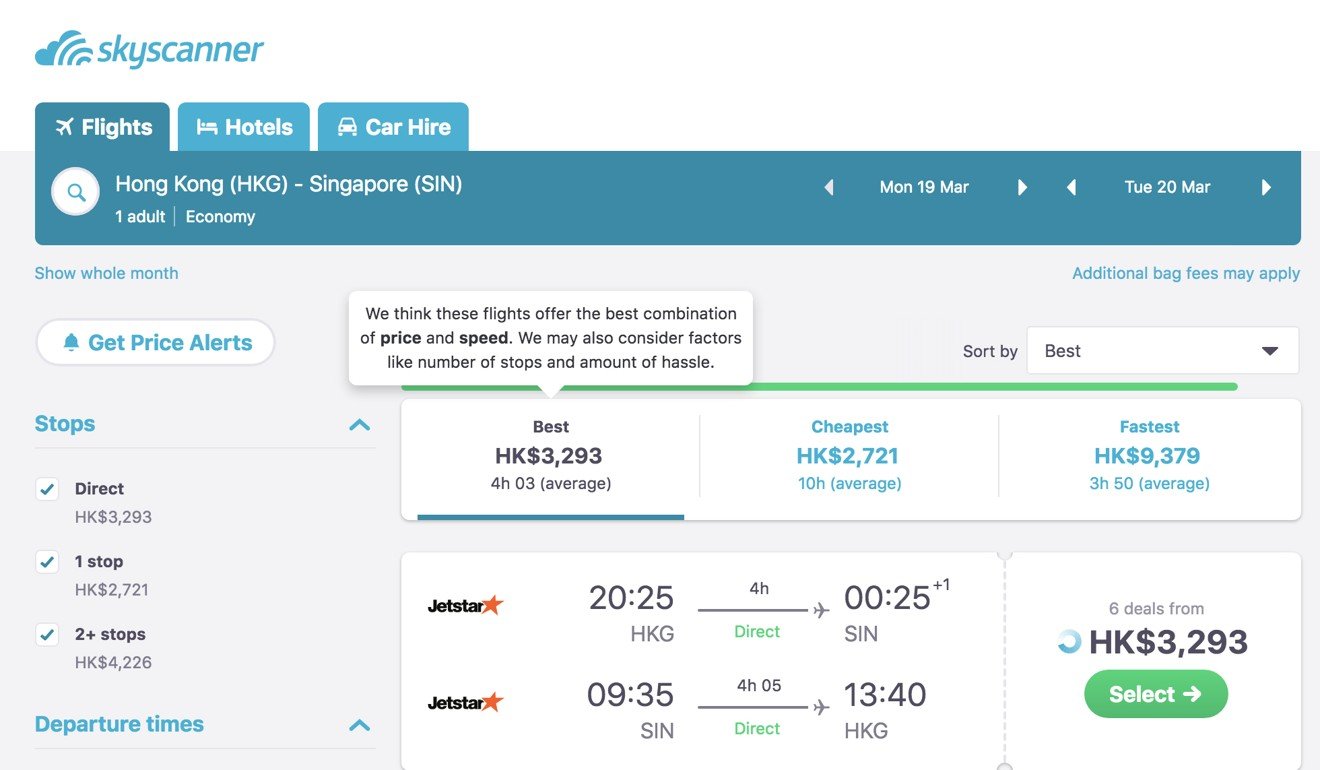

“Skyscanner is the smallest player of the three – its biggest impact is in Europe, but it is also expected to grow significantly in Asia since becoming part of Ctrip,” says Rauch.

Renamed from Gogobot, Trip.com is a discovery app owned by Ctrip.

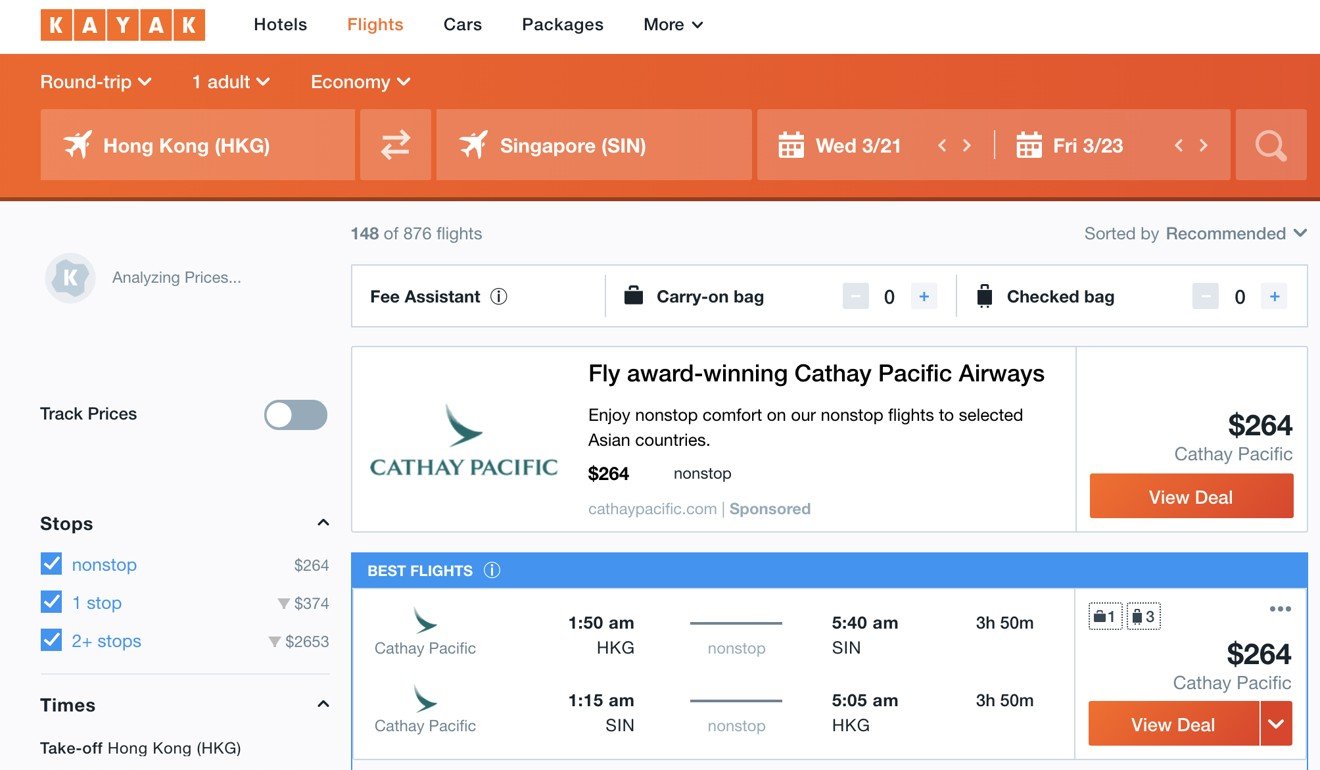

For now Google Flights and Kayak remain the major players in this market. “Google Flights and Kayak are the gatekeepers, commanding significantly more visits than smaller players,” says Rauch.

China’s Ctrip expands global reach with US$1.74bn Skyscanner takeover

With that growth spurt, a speed advantage, and integration with so many of its other apps, you can’t help thinking that, outside China, Google Flights’ journey has just begun.