China targets ‘future industries’ in 2024, humanoid robots and biomedicines to drive high-quality economic growth

- Beijing aims to boost tech-heavy sectors, from new materials to biomedicines and high-end equipment, to move ahead with advanced manufacturing development

- Application of 5G tech, strengthening 6G pre-research and accelerating the deployment of intelligent computing facilities also listed as key missions for 2024

Beijing has set developing “industries of the future” as one of its key missions for the year to come, as it ramps up efforts to explore frontier technologies as a major driving force for China’s economic growth.

The Ministry of Industry and Information Technology said at a meeting on Thursday that it would boost a wide range of tech-heavy sectors from new materials to biomedicines and high-end equipment to press ahead with China’s advanced manufacturing development and ensure high-quality growth.

“An action plan for the development of industries of the future will be introduced,” the ministry said in a statement.

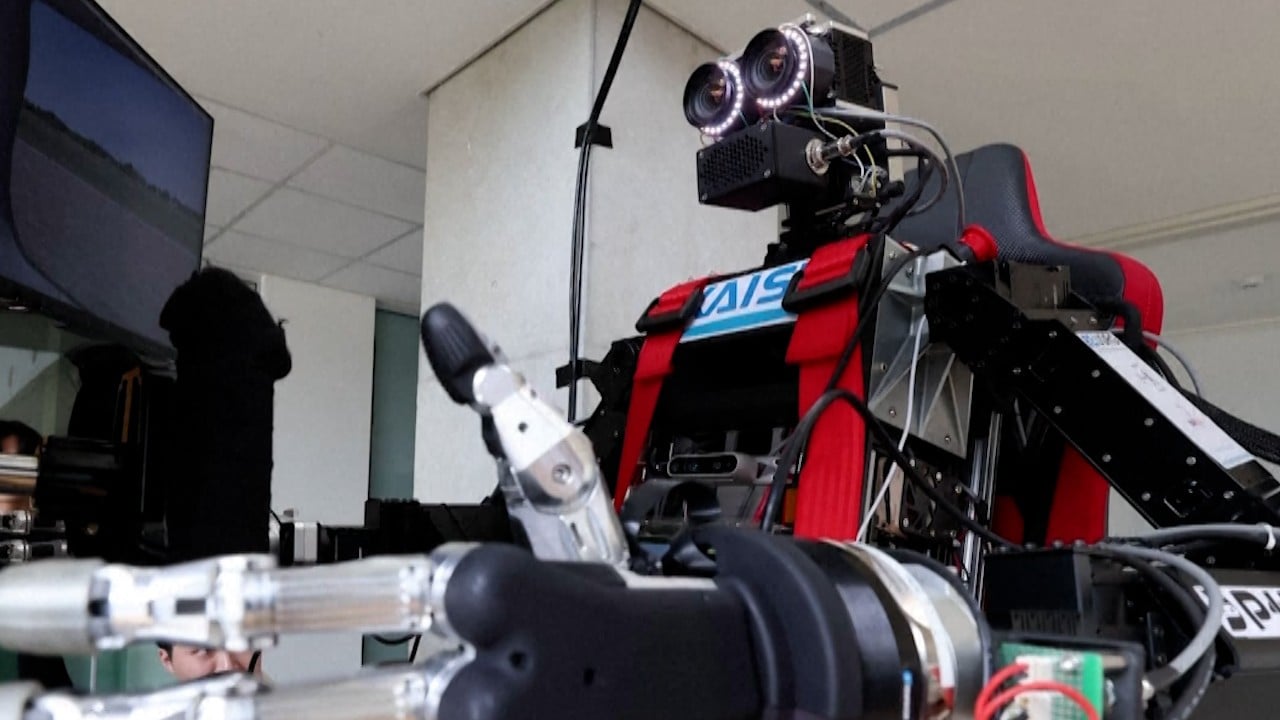

The plan would target sectors including humanoid robots and quantum information, and focus on breakthroughs in key technologies, cultivating products and expanding application scenarios, it added.

But there is still considerable progress needed to achieve high volume production and commercial application.

China’s industrial output is expected to increase by 4.3 per cent this year, compared to a 3.6 per cent rise in 2022, the ministry said.

China’s ‘involuted’ new-energy industry awash with self-defeating overcapacity

The real estate sector, which was once China’s biggest economic engine and contributed around 25 per cent to the national gross domestic product, has continued to falter, becoming the heaviest drag on the economy despite rounds of policy stimulus.

Beijing has provided substantial support for the new energy sector – represented by photovoltaic and electric vehicle industrial chains – as the new economic drivers.

And on Thursday, the Ministry of Industry and Information Technology also vowed to “strengthen regulatory guidance for industries with overcapacity”, while “consolidating the leading position in advantageous industries”.

Detailed plans include supporting battery-swapping models for new energy vehicles and promoting a comprehensive electrification of public sector vehicles in pilot areas, as well as strengthening standard guidance and quality supervision in the photovoltaic industry.

It also pledged to promote high-end applications of rare earths, including in aerospace, electronic information and new energy sectors.

Is the EU sharpening its ‘trade weapons’ toward China with carbon import tax?

The meeting set promotion of large-scale applications of 5G technology, strengthening 6G pre-research and accelerating the deployment of intelligent computing facilities as key missions for 2024.

It also vowed to promote low-carbon industrial development and strictly restrict new production capacity in iron and steel, cement and flat glass.

China is grappling with its carbon emission reduction targets and also a new carbon tax implemented by the European Union.