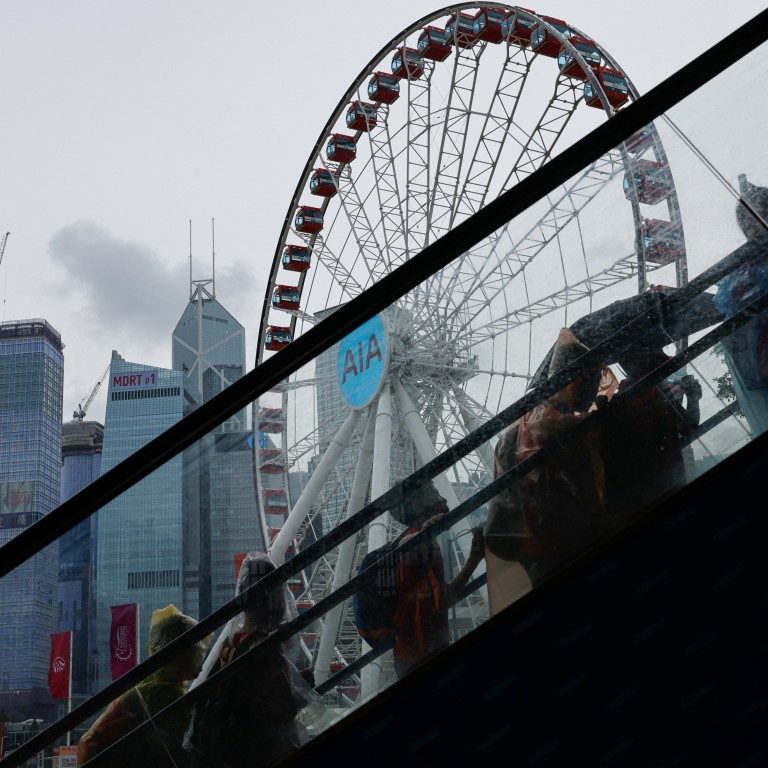

Will Hong Kong or Singapore finance the Global South’s pressing needs if the rich North won’t?

- The global financial system has failed to divert sufficient assets to support developing countries in meeting the Sustainable Development Goals

- If the Global South is to be heard on the global stage and shape its own future, its financial institutions must step up

The United Nations said the funding gap for developing countries to meet the 2030 Sustainable Development Goals (SDGs) is around US$4 trillion per year, or roughly 4 per cent of world GDP. In its August report on lifting economies out of poverty and beginning its net-zero transformation, McKinsey Global Institute estimated that the world would need investment of 8 per cent of global GDP annually this decade.

Although these numbers are high, McKinsey’s study showed that funding for change is available – provided there’s political will. From 2000 to 2021, it said, the global balance sheet grew 1.3 times faster than GDP, with about US$500 trillion in financial sector assets. A global financial system with such assets (US$486.6 trillion according to Financial Stability Board estimates) should not find funding of between US$4 trillion and US$8 trillion impossible to achieve.

But one reason the global financial system is reluctant to fund the SDGs is that the advanced rich countries are taking a lot of the global savings. The United States alone had a net international investment deficit of US$16.2 trillion at the end of 2022.

Due to these large US fiscal deficits, the Congressional Budget Office estimated that the US federal budget deficit would fall from 12.4 per cent of gross domestic product in 2021 to 3.7 per cent of GDP this year. It estimated that the deficit would rise to 6.1 per cent of GDP by 2032 – significantly larger than the average deficit of 3.5 per cent of GDP over the past 50 years.

In short, if the rich countries do not devote funding towards the SDGs, and instead spend on domestic defence and consumption, the world is doomed to have a burning planet and social disorder.

Within Asia, the richer and ageing economies of Japan, South Korea, mainland China, Taiwan and Hong Kong are huge net savers. Including Singapore, their net investment surpluses amounted to US$10.8 trillion.

A large part of the savings have been invested in US and European financial assets or foreign direct investments, with a considerable share intermediated by the international financial centres of Hong Kong and Singapore. The financial centres in the Gulf may also emerge as important funders of the needs of Central Asia, the Middle East, Africa and South Asia.

Southeast Asia and India are set to be the next growth zones. With their large and younger populations, they will need massive funding for poverty eradication, infrastructure building and net-zero investments.

At the end of 2022, Hong Kong had gross international assets of HK$47.4 trillion (US$6.1 trillion) and a net position of US$1.76 trillion. In comparison, Singapore had gross international assets of S$7.1 trillion (US$5.2 trillion) at the end of 2022, and a net investment position of S$1.1 trillion (US$813 billion).

Since both financial centres act as intermediaries for global flows, the issue is whether they have the right set of financial institutions to intermediate the supply and demand for funding the structural transformation of the Global South.

Overall, the lending by multilateral development banks (such as the World Bank) is too small to make a big dent. Constrained by the unwillingness of their majority shareholders to increase their capital, their total annual lending is around US$130 billion.

Although Hong Kong and Singapore have very large banking systems, the Basel rules on capital, liquidity and total leverage caps have on the whole made banks much more cautious in taking risks to finance long-term infrastructure and SDG projects.

The only possible institutions that may be willing to take more risks are insurance companies, pension and provident funds and sovereign wealth funds. Insurance companies remain cautious due to growing natural disaster risks, while long-term pension funds have kept their asset allocation to advanced countries. Sovereign wealth funds, meanwhile, have grown in size to over US$10 trillion in global assets, but they are only recently more willing to take higher risks in alternative assets.

All in all, if New York, London, Frankfurt and Tokyo are willing to fund mostly advanced-country needs, will Hong Kong and Singapore be prepared to take on the higher intermediation risks of the Global South?

For all its flaws, China’s belt and road has lifted the Global South

It is difficult to say, “Let the market decide”, because free-market flows are now complicated by geopolitically driven sanctions and central bank interventions, as governments become more protectionist and interventionist.

Given the excessive and growing debt burden, the only funding which can absorb higher risks is equity funding. But, currently, such funding is chasing tech IPOs, which are also increasingly geopolitically charged.

It is too glib to conclude that climate change and SDG funding will not be met by the current international financial system. When – not if – climate disasters and social disorders erupt, financial systems cannot escape losses, or the responsibility for being unwilling to take the risks of meeting the needs of the real economy. If the real economy fails, so will the financial systems.

Bluntly speaking, the West is no longer thinking for the rest of the world. Economies in the West have enough of their own problems in beating back the challenge of rising powers. The future of the Global South will be shaped not just by alternative visions of disparate and diverse views, but also by how their financial institutions respond and adapt to new geopolitical realities.

Andrew Sheng is a former central banker who writes on global issues from an Asian perspective