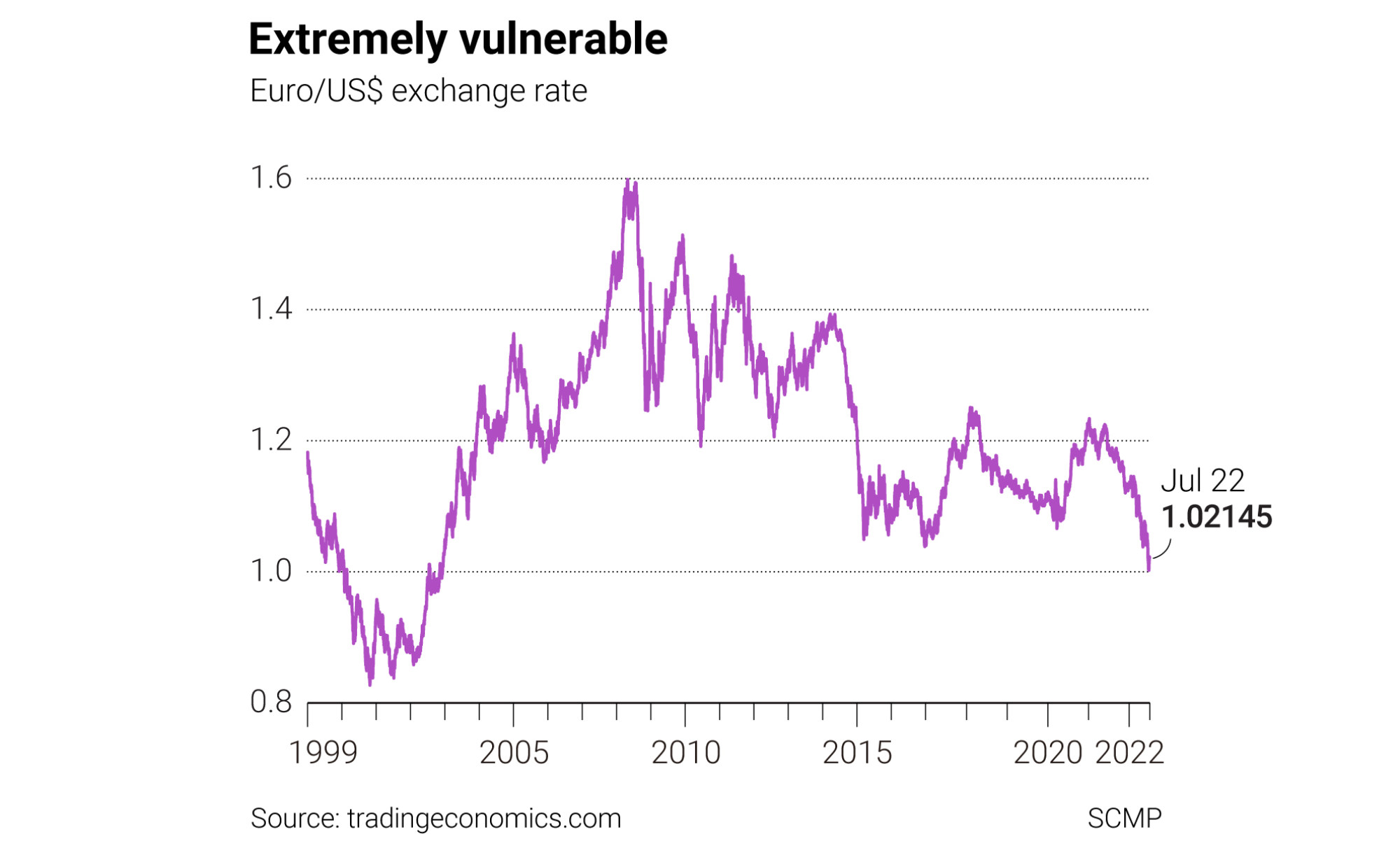

Ukraine war, energy crisis and Italy’s political turmoil call euro’s survival into question

- A worsening European energy crisis could raise the risk of a recession while the gap between the US and European central banks’ monetary policy will put downward pressure on the euro

- Big euro currency investors like China should consider cutting their losses and hedging their bets

Who would blame anyone for thinking that Europe is finished? Russian President Vladimir Putin might have achieved his aim to crack European unity, with the economy suffering on a number of fronts.

Big euro currency investors like China should consider cutting their losses and hedging their euro bets in the global currency markets. In the present turmoil, the US dollar has only one way to go and that’s up.

German industry is already feeling the pinch with the bellwether IFO business confidence indicator showing the strain over the past few months as the spectre of gas shortages deepens industry’s concerns about disruption to future output and growth. The business climate index has fallen from a peak of 101.4 in June 2021 to a low of 90.8 in March and sentiment is still struggling.

The worry for Europe’s leaders is that the united front towards Russia could be at risk if countries break ranks to secure vital energy deals to last industry through the winter. If Russia tightens its stranglehold on Europe’s energy supplies, the risk of a recession could rise very sharply. If Germany slips into recession, the odds are that it will drag down the rest of Europe with it.

Forecasting expectations have yet to catch up, with the latest projections from the Organisation for Economic Cooperation and Development in June still anticipating 2.6 per cent growth for the euro zone as a whole this year. The odds are that the euro zone could be slipping into negative growth by the end of the year.

This should be the point in the cycle where the ECB is easing monetary policy to lessen the chances of a more serious downturn. Unfortunately, its hands are tied to battening down euro-zone inflation, which jumped to a record high of 8.6 per cent in June from 8.1 per cent in May.

The ECB has been slow to increase rates, leaving the euro exposed to the quicker pace of monetary tightening from the US Federal Reserve.

This imbalance is unlikely to change soon, posing even more downward pressure on the euro relative to the dollar. Meanwhile, the rise in European borrowing costs from higher interest rates and bond yields will continue to drag on consumer and business confidence.

The benchmark spread between 10-year Italian and German government bond yields has already widened to 2.42 percentage points from around 1 percentage point in early 2021 as risk perceptions have risen, with markets looking anxiously towards previous precedents of almost 5 percentage points at the height of the 2011 European debt crisis. The odds of an Italian-linked credit event and a wider European debt crisis are rising.

Europe needs a period of calm, positive leadership and financial stability. Without it, Europe could be dragged into a new existential test of the euro. Whatever the outcome, the ECB’s efforts to drag euro interest rates radically away from zero per cent will be doomed to failure.

David Brown is the chief executive of New View Economics