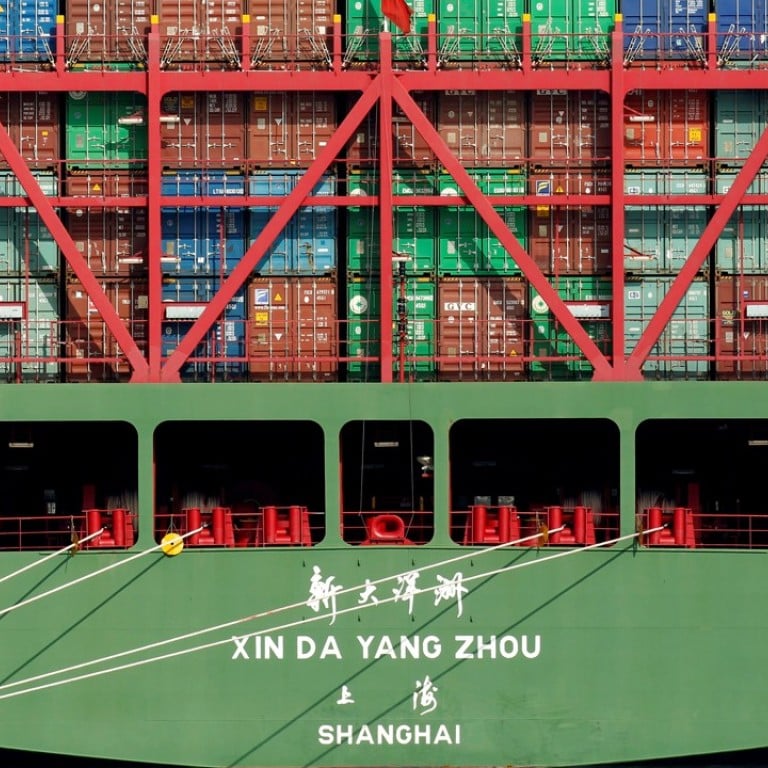

China broke the rules of global trade – but for good reason

Daniel Poon says the global trade regime that now exists has become an example of institutional overreach: backed by its developed-country members, the WTO has effectively reduced the policy space of developing countries to become rich themselves

It is widely acknowledged that the state played a substantial strategic role in these cases.

For those wishing to replicate their success, however, some argue that the relevance of their experience is limited because the global trading system has changed. Policy instruments like “performance requirements” that were once permitted were banned when the World Trade Organisation came into force in 1995. Other practices, like technology licensing agreements, were discouraged in favour of foreign direct investment flows, which allowed foreign investors greater control over technology transfers.

Under the new rules, the trading system became much less permissive. Rules that focused on reducing tariff barriers were expanded to the service sector, intellectual property rights and domestic subsidies, among other areas. Efforts to extend multilateral rules to the areas of investment, government procurement, antitrust, and trade facilitation were resisted, but inroads were made via the proliferation of regional and bilateral free trade agreements.

In establishing discipline in these new policy areas, some flexibility was allowed, though such exceptions were generally limited in scale, scope and time.

Watch: Trademark disputes between Chinese and US companies

Trade rules are important in providing a reliable framework for exchange, but the multilateral trade regime became a glaring example of institutional overreach: backed by its strongest developed-country members, the WTO has effectively reduced the room for manoeuvre – or policy space – of developing countries. This is known as “kicking away the ladder”, whereby rich countries deny other countries the policy tools that they used during their own development process.

China started its economic reform and opening up 40 years ago, but it joined the WTO only in 2001. Under the stricter rules of the WTO, and the spread of global value chains, China’s policymakers faced tough reform choices, but were well aware of what they had (and had not) signed up to.

As Long Guoqiang, vice-president of the Development Research Centre of China’s State Council, put it, “the design of an opening-up strategy is to serve national development objectives. By itself, opening up is not an objective. At any given stage of development, designing an opening-up strategy is to realise national objectives for that stage of development.”

This nuanced view to economic openness speaks to the pragmatic but sequential pace of reform measures in China’s development strategy.

Watch: What’s the beef with the ‘Made in China 2025’ strategy?

The number of foreign equity restrictions – with joint venture requirements – has been relatively steady since China’s first FDI “guidance catalogue” in 1995, reaching a peak of 186 in 2007. Only by 2015 has there been a clear reduction, with the number of restrictions dropping further, to 63, in 2017. Meanwhile, the focus of these restrictions has shifted over time from manufacturing to service sectors.

The guidance catalogues were possible because China kept full control over such investments, attaching conditions that must be met before the investments are approved.

Size is important, but it is bargaining power that is at the crux of trade negotiations

In general during China’s opening up, many conditions were set in terms of market access, equity, product, scope and supervision. If China is now relaxing restrictions, it is only because its leaders are assured that the economy is at a stage of development where fewer restrictions are needed.

To take an example, the banking sector has been “restricted” since the first guidance catalogue, with foreign investors later allowed, but limited to a 25 per cent equity stake. But when foreign banks’ share of total banking assets fell from 2.4 per cent in 2007 to 1.3 per cent in 2016, restrictions could gradually be relaxed.

To be sure, the global trade regime has its weak points that can be exploited, notably by larger developing countries with some institutional capabilities. In the context of recent US-China trade frictions, China’s size and “strategic patience and calm” brought the US back to the negotiating table.

Size is important, but it is bargaining power that is at the crux of trade negotiations. Developing countries of all shapes and sizes must practise strategic patience in reclaiming lost policy space, while also identifying sources of new space.

Daniel Poon is an economist with the United Nations Conference on Trade and Development (UNCTAD). The opinions expressed in this article are solely those of the author