Pain is the only certainty in Britain’s confused Brexit plan

David Brown says confidence in the already struggling UK economy is falling as the country continues to bicker over the arrangements of its exit from the EU

One thing is very clear: as a nation, Britain seems in deep denial about what happens next. How businesses commit to new investment, consumers invest in the future and financial markets go about their business without deeper foreboding is baffling. There is a growing resignation that everything will be alright on the night, but it won’t. Whatever happens after 2020, Britain will have changed immutably. Not quite our darkest hour, but certainly one of the starkest.

The growing uncertainty is stripping Britain bare of its best future potential. Under Brexit’s cloud, de-industrialisation is picking up pace, Britain’s welfare state is under growing duress and the City of London – the jewel in the nation’s crown – continues to see a rush to the exits.

There is no sign of any galvanising national plans to find a way out of the mess. Britain’s political and business leaders seem at a complete loss over how to rally the nation.

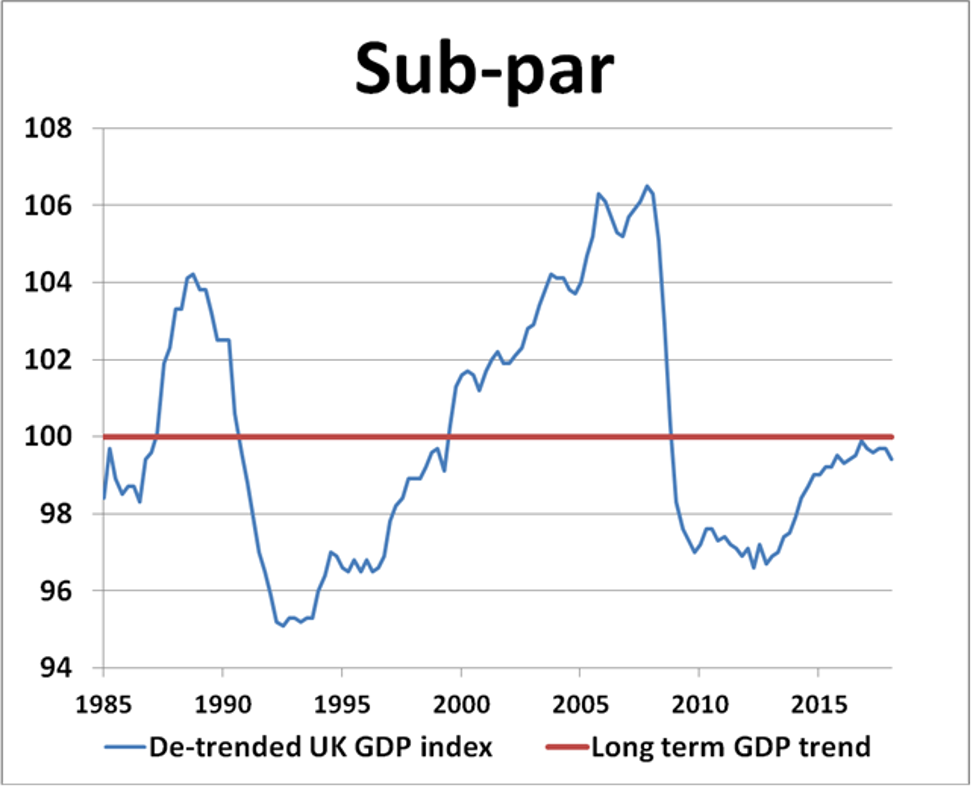

Set against all this, it is no surprise that the UK economy is losing heart and juddered to a halt in the first quarter, with gross domestic product barely up by 0.1 per cent. Optimists blame the slowdown on bad weather and the “Beast from the East” cold spell, and expect output will spring back next quarter. The realists believe the slowdown is inevitable, the result of an economy going into toxic shock and a sign of more disappointment to come.

Replacing free access to Europe’s customs union with better access to world trade markets is one thing, but safeguarding British industry once outside the protective shield of the single market is simply a pipe-dream right now. Successful British companies are easy pickings for foreign acquisition and future UK governments must come up with solutions to encourage new start-ups and protect the best of what Britain has to offer right now.

There are some bright spots in the economy, but they tend to be overshadowed by the black holes opening up in the UK outlook. Consumers remain the driving strength of the economy, but recent weakness in the British high street underlines troubles ahead. On the corporate side, the FTSE share index continues to make hay while sterling sinks like a stone, but is hardly a vote of confidence in UK company performance. It is a trade that is unlikely to last long.

Set against all this uncertainty, British policymaking remains in a muddle. The Bank of England is stymied on planned interest rate rises with growth stalling. Gaping holes in government finances are forcing major rethinks on much-needed public spending and investment initiatives.

Britain’s economy is on the ropes. Whether the country muddles through or is heading for the rocks is hard to say. Confidence remains Brexit’s biggest victim, leaving UK stocks, bonds and the pound in dire peril over the coming months.

David Brown is chief executive of New View Economics