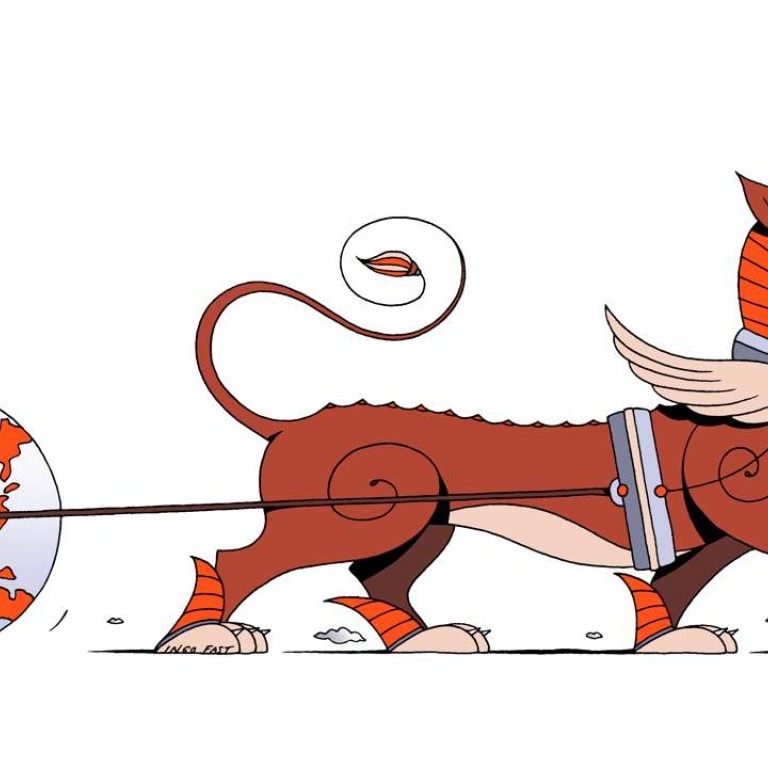

Made in Asia for Asia: How the rise of its middle class is remaking the world economy

Peter Wong says Asia, with its growing middle class hungry for consumption, will lead the new world order of the 21st century, bolstered by the RCEP free trade plan and the belt and road initiative

The emergence of an East-East trade and investment corridor, boosted by the significant and largely unexpected economic and political events of 2016, is expected to fundamentally alter the present world order.

Throughout history, Asia has accounted for the largest share of the global gross domestic product: the “Great Divergence”, during which countries in the West outstripped the rest of the world economically and technologically, was an anomaly. In the 20th century, the world’s economic centre of gravity began to shift back to the East – as first Japan, then the four Asian “tigers”, and finally China, India and Southeast Asia underwent rapid industrialisation. But the health of the global economy is still dependent on the appetite of consumers in the West.

Asia, led by China, set to play a bigger role in the evolution of global trade

The present world order is underpinned by an East-West corridor: goods are made in the East and sold in the West. But with globalisation under attack, the world is evolving into big regional trading blocs. The result is less global trade but vastly increased regional trade.

If the 20th century belonged to America, then the 21st century will surely belong to Asia. In the years to come, an East-East corridor will form the spine of a new world order – goods will continue to be made in the East, but an increasingly large portion will also be sold in the East.

By 2025, Asia will become the world’s leading trade region, with much of the growth coming from intra-regional commerce. At the moment, trade within Asia is worth slightly more than inter-regional trade, but it is forecast that, by 2020, intra-Asian trade will be worth about twice as much as Asia’s trade with the rest of the world.

Globalisation’s not dead, it just has a new powerhouse – Asia

Asia is home to the largest and most dynamic group of consumers. This new army of spenders is entering their first phase of acquiring houses and flats. They are paying for their children’s tuition as well as their own medical insurance. More importantly, they are not as reliant on debt for their spending as their Western counterparts.

By 2030 ... two-thirds of the global middle class will be living in Asia

The rise of the Asian consumer will be a dominant economic theme for the next several decades. By 2030, it is forecast that two-thirds of the global middle class will be living in Asia. In contrast, North America and Europe will together account for only a fifth of the world’s middle-class population, down from more than half in 2010.

A similar trend can be found in middle-class consumption. Whereas it is forecast that by 2030, North America and Europe combined will account for 30 per cent of the world’s middle-class consumption (down from 64 per cent in 2010), Asia will account for nearly 60 per cent – with more than two-thirds coming from India and China.

China’s consumer confidence sharply higher in 2017, says Credit Suisse

The forecasts of the emergence of an East-East corridor, in which goods are made and also sold in the East, are bolstered by two developments originating in Asia. The first is the Regional Comprehensive Economic Partnership (RCEP).

The RCEP is poised to be the first pan-Asian free trade agreement, linking the world’s three largest consumer markets – China, India and the Asean – as well as Australia, Japan, New Zealand and South Korea, in a deal spanning goods, services and investment.

If the 20th century belonged to America, then the 21st century will surely belong to Asia

The belt and road strategy may be a Chinese initiative, but it is in actuality a regional and global effort involving developed and emerging markets, as well as international organisations. It can even be a catalyst for capital market development in Asia. Belt and road projects will be funded publicly, privately, and by international financial institutions such as the Asian Infrastructure Investment Bank.

There will be onshore and offshore financing options denominated in renminbi. But its bond issuance will also draw heavily on other major global currencies, as well as local-currency bond markets along the belt and road. Better-developed bond markets in Asia would reduce the region’s reliance on bank debt, help recycle Asian savings into Asian investment, and boost the region’s resilience against capital flows driven by external events.

The rise of Southeast Asia’s consumer class

The success of RCEP and the belt and road strategy will thus lead to a virtuous cycle in the East-East corridor, with goods production and sales both taking place in the East, and regional savings ploughed into regional investment opportunities.

Since the end of the second world war, economic opportunities have lain in catering to the rising consumer demand in the West. But the emergence of an East-East corridor is evident.

Total population in the West stands at about one billion; Asia’s middle class will reach that figure by 2020. With the East-East corridor forming the backbone of a new world order, Asia can take the lead in promoting closer trade and investment links around the world.

Peter Wong is deputy chairman and chief executive of the Hongkong and Shanghai Banking Corporation Limited