HKEx boss warns of Stock Connect hurdles

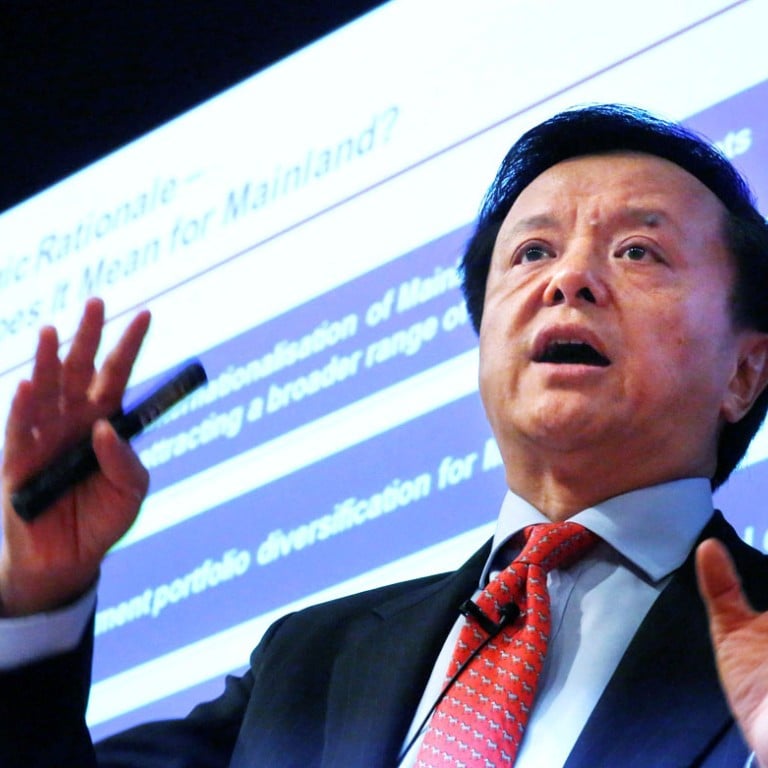

Hong Kong Exchanges and Clearing chief executive Charles Li Xiaojia has spelled out in his official blog many hurdles presented by the Shanghai-Hong Kong Stock Connect.

Hong Kong Exchanges and Clearing chief executive Charles Li Xiaojia has spelled out in his official blog many hurdles presented by the Shanghai-Hong Kong Stock Connect.

The scheme, set to kick off in October, will, for the first time, allow individual Hongkongers to own and trade mainland A-shares without the need to go through a qualified institutional investor.

It will also open Hong Kong’s H-share market to mainland investors.

Li has emphasised in presentations that the plan is a major coup for the Hong Kong exchange. The Hang Seng China Enterprises Index, the benchmark H-share index, has risen 9 per cent since news of the scheme broke in early April, and Li says in his blog that “many are excitedly waiting for the scheme to begin”.

However, Stock Connect faces many hurdles, Li says. He notes, for example, that the scheme will only be in effect when both the Hong Kong and Shanghai exchanges are open. When one exchange is closed for a public holiday or for a typhoon, trading and clearing is suspended, even if the other bourse remains open.

Li also flags the difference in settlement times between the two markets. Hong Kong gives investors two days to settle their trades, but Shanghai requires instant settlement.

In practical terms this means investors wishing to sell stock will have to tell their share custodian to transfer shares to the selling broker before the deadline of 7.30am that trading day, Li said. This rules out the possibility of intraday trading, or day trading.