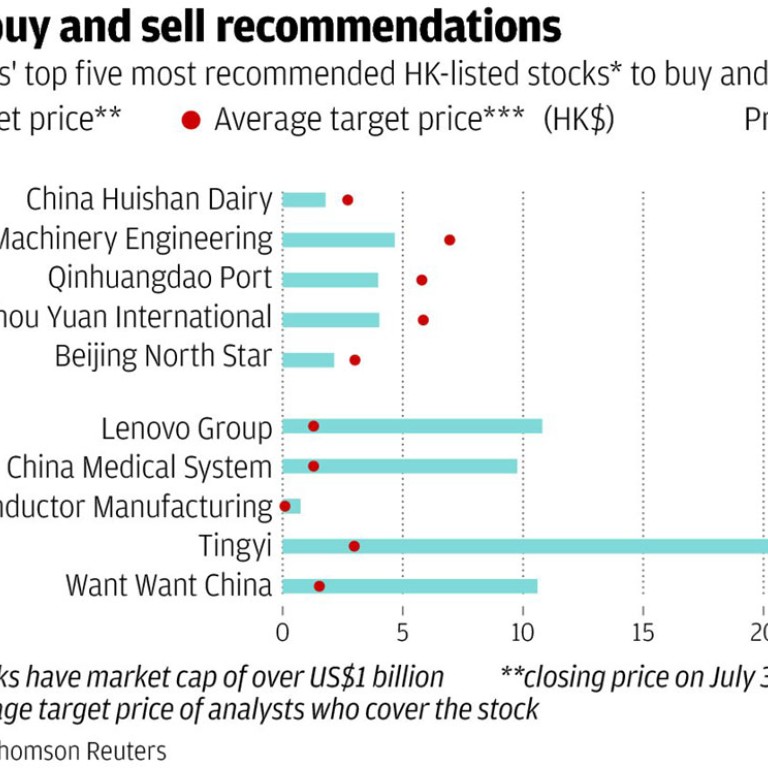

Analysts pick top five Hong Kong-listed stocks to buy and sell

Analysts' recommendations are certainly not the only reason to trade a stock, but they can help investors in their decision making.

Analysts' recommendations are certainly not the only reason to trade a stock, but they can help investors in their decision making. Brokerage analysts who cover the Hong Kong market routinely move share prices, often because the only fresh information on a stock will come in the form of a new rating from this community.

In that spirit, the surveyed the Hong Kong market looking for analysts' top five buy and sell recommendations. The data analysis was done by Thomson Reuters, which looked at analysts' average target price and compared that with a stock's actual traded price. All stocks have a market capitalisation of more than US$1 billion.

The top pick, China Huishan Dairy, is a small mainland milk producer. The company trades at a discount to its peers - at eight times current earnings versus a sector average of 14-20 times.

This is partly because of its limited track record. It only listed on the Hong Kong exchange in September 2013.

Private equity funds also continue to hold shares in the firm and are expected to sell once various lock-ups expire, and that weighs on its share price.

Nevertheless, analysts view this stock as the most undervalued on the local bourse.

"Not the strongest in fundamentals but the cheapest in valuation," said Anson Chan, who covers Huishan Dairy for Daiwa Securities.

Fu Shou Yuan is the fourth most recommended buy in this survey, largely on its scarcity value. It is the only cemetery operator listed in Hong Kong. It sells burial plots in its cemeteries throughout the mainland.

When it listed last year, it was the most heavily subscribed Hong Kong listing of that year. This is a high-margin, high-growth business, considering China's rapidly ageing population - and there are barriers to entry; Homeowners object if their neighbourhood is turned into a cemetery.

The firm also owns a huge site in Shanghai, and priced on that land alone, the firm is valuable.

Turning to sell recommendations, the computer giant Lenovo is the most recommended stock for disposal. The firm has two large acquisitions pending, one for Motorola's handset business, and the other for IBM's server business. Both acquisitions are being reviewed by US regulators and that is creating a lot of uncertainty about Lenovo's outlook.

The firm's share price has also been trading up recently and is above its historical average price-earnings ratio. "Their share price has been doing well so it's not a bad time to profit," said Steven Tseng, who covers the stock for Daiwa.

Then there is Semiconductor Manufacturing International Corp (SMIC), a Shanghai foundry that makes microchips to order for other firms. It is a longstanding laggard in its sector, trailing stalwarts such as Taiwan Semiconductor Manufacturing Company.

Following years of underperformance, the company simply has never attracted much respect from analysts or investors.

"They are two generations of technology behind the leaders, the firm is very volatile in terms of earnings, and management historically under execute. The street has been quite negative on this firm for a long term," said Chris Yim, who covers SMIC for Mizuho Securities.

Want Want is another candidate. A Taiwanese snack and beverage firm with a long track record, the firm has been suffering recently because of a price war waged by competitors Bright Dairy and Yili. The companies have been cutting prices on their milk products to clear inventory, according to KGI Securities analyst Alice Leung. This has forced Want Want to cut prices on a flagship product, Hot Kid Milk, which accounts for about 40 per cent of its sales.