Can a bear equity market ignite interest in fine wines as an alternative investment in China?

China’s rise as the world’s second biggest wine market will also benefit Hong Kong, which is the region’s auction and trading centre for fine wines

With China set to emerge as the world’s second largest wine market by 2021, industry observers expect an increase in the number of investors in the mainland who value fine wine as an alternative investment.

The current bear capital market in the mainland might make the point even more apparent for Chinese investors, according to UK-based fine wine investment company Cult Wines.

This week, Shanghai’s benchmark stock index plunged to its lowest level in two years. It entered bear territory this week after losing more than 20 per cent of its value since its peak in January.

“The current bear market in China is actually supportive of Chinese investors looking to diversify their portfolios globally and considering an allocation to the fine wine market,” said Lu Yijun, research analyst at Cult Wines, adding that the subsequent impact of increasing market anxiety will continue to support positive trends in the fine wine market over the long term.

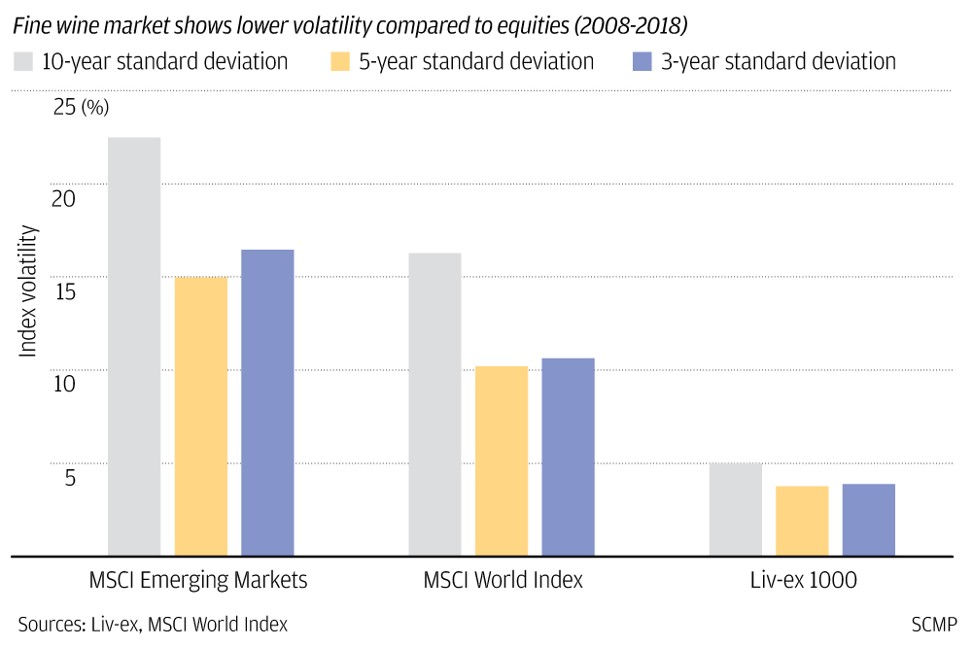

The company’s latest study showed that fine wine investments were less volatile than global equity markets and is also little correlated to the traditional financial markets.

For instance, the volatility of Liv-ex 1000 index, the broadest measure of the fine wine market, sat at 5 per cent during the 10 years until December 2017. While in the same period, the MSCI World Index, which represents large and mid-cap equity performance across 23 developed markets, fluctuated by 16.3 per cent.

A report from private bank Julius Baer has shown similar findings.

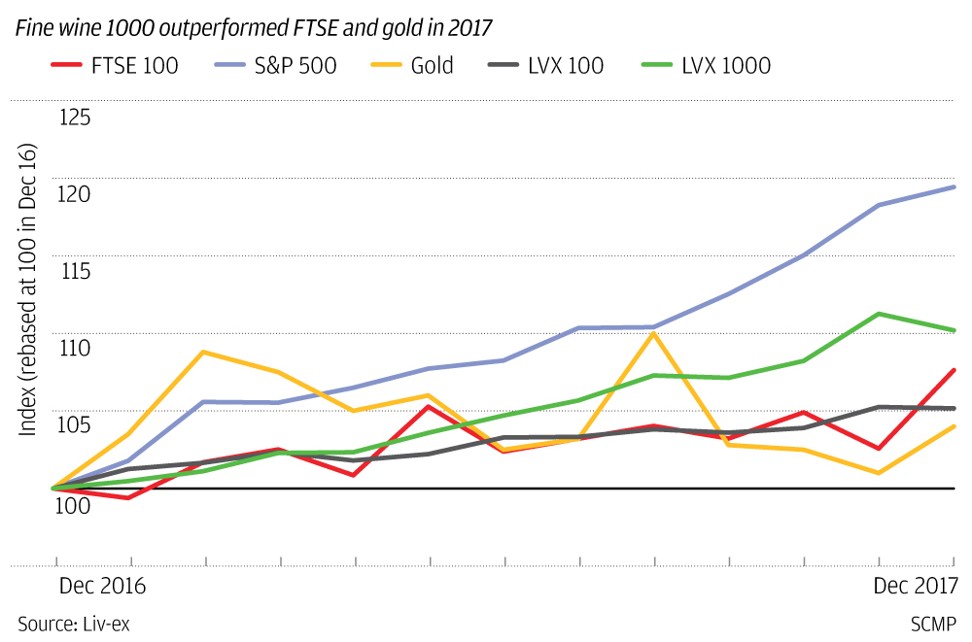

In the past 12 years, fine wines have outperformed global equities and gold, said the Swiss bank. At the same time, wines were also less volatile compared to the yellow metal, a traditional safe haven.

However, investors also need to be aware of the risks while betting on the assets whose supply depends on the whims of weather and demand can fluctuate.

Also, it is a small market with low liquidity and high dealing cost. Currency risk could be another issue as the best wines are mainly traded in British pounds.

“Investors would do well to undertake due diligence with respect to the potential pitfalls such as pricing and limited liquidity,” said Julius Baer in its study on luxury wine in Asia.

According to a joint report by Vinexpo and IWSR Magazine, the US was the world’s top market for wines worth US$35 billion in 2016 and is expected to grow by 25 per cent to reach US$45 billion by 2021. Meanwhile, China’s market is expected to grow 30 per cent from US$15.24 billion to US$23 billion over the same period.

Hong Kong can play an important role in growing the Chinese market as it is an important trading hub for the Asia-Pacific wines and spirits market. Hong Kong is also one of the largest wine auction centres in the world, with auction sales amounting to US$92 million in 2016, according to data from HKTDC Research.

Hong Kong can also benefit from the growth as the city has been a key market for Chinese consumers and collectors to source their wines especially since 2008, when import duty on fine wines was relaxed, said Joe Alim, head of Cult Wines in Hong Kong.

“With the level of demand set to increase over the coming years, it would be fair to assume that the Hong Kong market will continue to play a key role in the process for wine entering the mainland,” he said.