Coronavirus in China: 2021 outlook brightens for health care operators, pharmaceutical and device makers after price cuts

- Hospital operators, internet-platform owners are likely to be among winners in 2021 as the pandemic impact wanes, Citigroup says

- Price pressures could hit drug and device manufacturers as China imposed new centralised procurement system

While vaccine deployment is certain to hog the limelight, Citigroup said internet platform operators can profit from ongoing policy reforms to spur greater adoption of online services and reduce hospital trips. Pressure on drug prices is a key challenge to market players, China Renaissance Securities said.

“We expect hospital operators to see better fortunes,” Cui Cui, head of China health care research at Citigroup, said in an interview with South China Morning Post. “Pharmaceutical firms whose new drug sales ramp-up has been slower than expected due to disruptions should also benefit, while internet health care platform operators should continue to do well.”

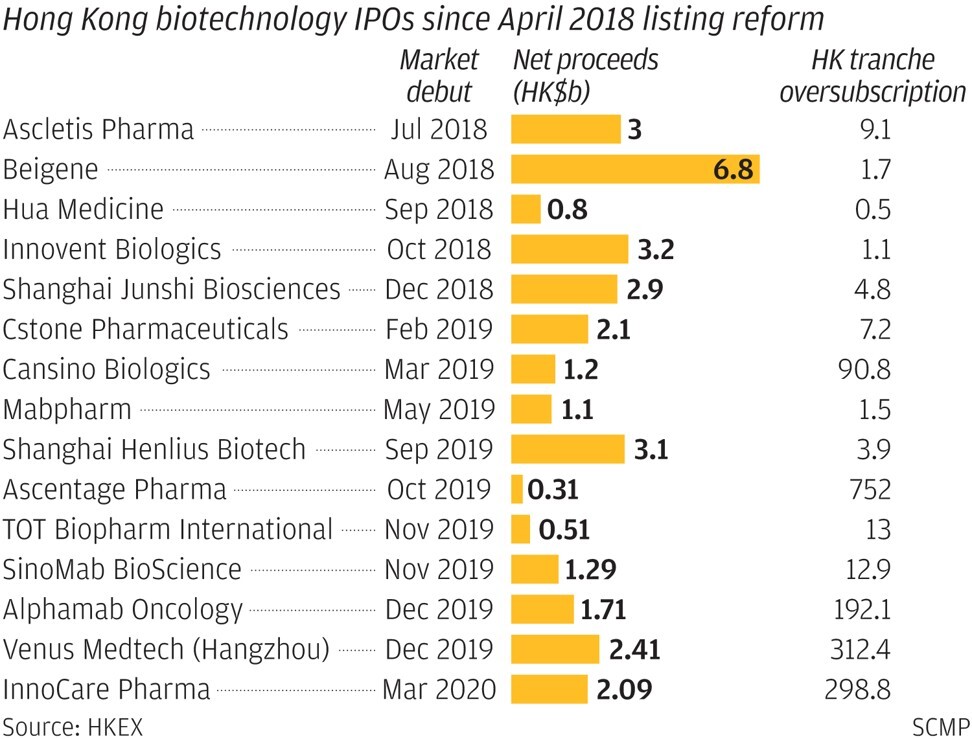

An MSCI index tracking 81 Chinese health care stocks with a combined market value of HK$1.15 trillion (US$148 billion) advanced 61 per cent in 2020, the biggest gain since 2003 as the pandemic fuelled online delivery channels. WuXi Biologics, the biggest constituent with 20.5 per cent weight, surged 213 per cent, making it the top performer among all Hong Kong-listed stocks.

A separate gauge for 80 mainland-listed players climbed 29.4 per cent in 2020. The biggest member, Jiangsu Hengrui Medicine, gained 53 per cent after a near-doubling in 2019, according to Bloomberg data.

“We expect Aier to resume expansion with the potential addition of some 102 new-build or acquired outlets in the next three years” to its existing 600-odd outlets, Nomura Orient analyst Wu Wenhua wrote in a November 25 report.

China’s health care industry marked a major milestone in November when the government included online repeat consultations for chronic and selected common diseases as “reimbursable services” under the state medical insurance scheme.

“As the single largest payer of China’s health care industry, as long as insurance reimbursement keeps expanding, the industry will benefit,” Zhao Bing, its chief health care analyst, said in an interview.

Zhao expects reimbursement to increase by more than 10 per cent in 2021, after hospital operations saw a strong recovery in the second-half of 2020, as some activities recovered as lockdowns eased.

This follows the end of negotiations for its centralised bulk procurement for hospitals for 2021 under a tendering process to eliminate profiteering, support innovation and make quality drugs more accessible to the masses. The government offers bigger purchase orders to suppliers with lower prices.

“Whether the larger orders can offset the impact of price cuts will depend on product to product,” Zhao said. “Generally, this is not possible in the first year. The upside is usually seen from the second or third year.”

“Because of Covid-19 disruptions, their new drug sales ramp-up has been slower than expected and has led to disappointing results in 2020,” she said. “Sales should normalise in 2021.”

For biotechnology start-ups that focus on innovative drugs development, Cui said competition in the popular PD-1 (L1) cancer immunotherapy category is expected to intensify as two or more new players join an existing field of eight local and foreign players.

Three PD-1 (L1) drugs have recently been included in the national insurance scheme’s reimbursement list, after manufacturers and distributors agreed to an average 78 per cent price cut, according to Everbright Securities.

The price pressure may not spare medical device makers, according to Citigroup, as China puts more products under its centralised procurement tendering process. Coronary stents in November saw a 93 per cent price plunge as a result.

“Stents were only the beginning,” Cui said. “We expect spine, hip and knee joints, implant products, artificial lens and pacemakers to follow suit.”