Is Tesla’s Shanghai plant announcement a matter of auspicious timing?

Wholly-owned Gigafactory puts US carmaker in pole position, in industry forecast to grow nearly six times by 2025

By committing to Shanghai, where it will set up its Gigafactory and become the city’s biggest foreign manufacturing investor, Tesla has taken pole position when it comes to vehicles powered by alternative fuels. Its timing could not be better – the industry is forecast to grow nearly six times in size by 2025.

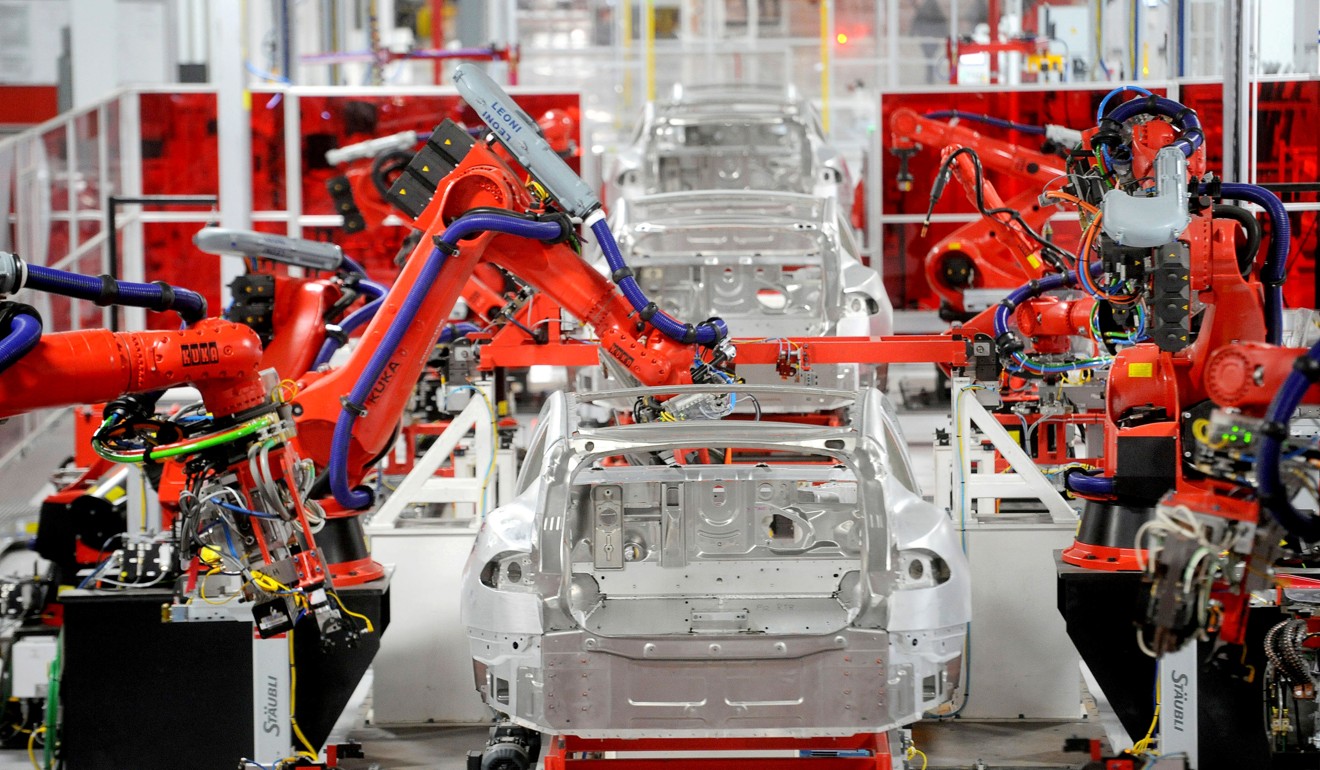

The Palo Alto, California-based carmaker’s assembly line in Shanghai, its first outside the United States, will also be the first wholly foreign-owned car manufacturing facility in mainland China, with Tesla taking advantage of Beijing scrapping ownership restrictions in the industry.

The timing of the deal is good, if China keeps its promise to open up to foreign players

Moreover, the local government will not push the US carmaker on previous technology transfer requirements either.

Huang Ou, the deputy director of the Shanghai Commission of Economy and Information Technology, said: “In terms of technology transfer, it is an issue to be settled through negotiations between enterprises.”

Huang’s statement, delivered to a press conference on Wednesday, implied the governmental would not be giving any orders. “How Tesla builds its plant and who it will cooperate with, it’s all the company’s own commercial operations,” he said.

The Shanghai government has said it will help the carmaker start production as soon as possible.

Tesla’s investment, announced just before US President Donald Trump said the White House was considering a fresh round of tariffs in the US’s simmering trade war with China, also brings it closer to its biggest potential market, as well as the materials needed to make batteries, currently half the cost of an electric car.

Its dependence on Panasonic in Japan and its Gigafactory in Nevada for batteries could increase Tesla’s manufacturing costs in China, and securing Chinese suppliers has to be an option it is considering, said analysts.

“Tesla has to jump onto the China bandwagon, which is on a fast track to growth,” said Cui Dongshu, the secretary general of the China Passenger Car Association. Cui said the low usage of new energy cars amid huge growth potential, and the government’s push towards clean energy vehicles added to China’s appeal for Tesla.

The production of electric vehicles, which made up a mere 2.3 per cent of the 29 million vehicles produced last year in China, could increase to 4.6 million units by 2025, or 12 per cent of the total vehicles produced, according to JPMorgan Chase.

In 2017, the sales of new energy vehicles soared by 53 per cent to 770,000, outshining the 3 per cent growth recorded by the industry as a whole.

“The timing of the deal is good, if China keeps its promise to open up to foreign players, including US investors, against the backdrop of an escalating trade war with the US,” said Cui.

Also this week, German auto giant BMW said it would work with Chinese partner Great Wall Motors to build a 50:50 joint venture in Zhangjiagang, in China’s coastal Jiangsu province, to make electric Minis.

Made-in-China Tesla models are expected to roll out of the Shanghai facility in two years, the company said in a statement. It could take another two to three years before the Tesla plant reaches its full capacity of delivering 500,000 models annually, the company said. It did not reveal how much it would invest in the Shanghai plant.

“Tesla is unrivalled in the luxury electric car segment at this stage,” said Cui. It remains to be seen how local rivals will use this time gap to catch-up, before locally produced Teslas hit the roads in China.