After fast track Shanghai listing, mainland biotech firm WuXi AppTec set for Hong Kong IPO

WuXi AppTec, the mainland’s leading biotechnology firm, has announced a plan to sell shares in Hong Kong, just two months after it went public in Shanghai via a fast-tracked listing.

The board has approved a plan for a listing on the main board of the Hong Kong stock exchange, and the new shares will account for 10 per cent to 15 per cent of its enlarged share total, the company said in a filing to the Shanghai Stock Exchange on Sunday.

WuXi said the specific fundraising scale, including pricing and the exact volume of shares to be sold, would be determined later. It would also choose a proper time window for the listing, which is dependent on regulatory approval and market conditions.

Wuxi AppTec was taken private in a US$3.3 billion deal in 2015, delisting from New York before a flotation in Shanghai on May 8.

The company has already raised 2.25 billion yuan (US$340 million) in Shanghai to replenish working capital and fund its expansion of research strength, labs and manufacturing capabilities.

It has become one of the most sought-after pharmaceutical firms on the mainland. Its shares closed at 94.95 yuan in Shanghai on Friday, more than quadruple its issuing price of 21.6 yuan.

“A listing in an established financial hub like Hong Kong is good for its global awareness and corporate governance,” said Dai Ming, a fund manager at Hengsheng Asset Management in Shanghai, who added that a dual listing made sense.

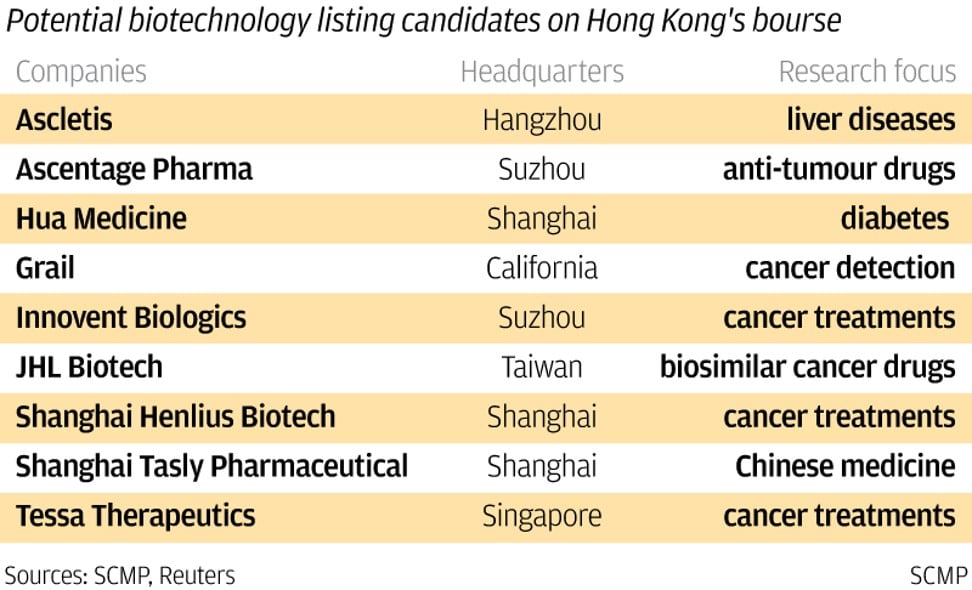

The Hong Kong stock exchange’s recent changes to its listing rules, which indicated a willingness to embrace new economy firms, could give Wuxi impetus, he said.

A flurry of new listings this year would help Hong Kong claw its way back to a top-three spot in global rankings, up from its No 5 spot in the first half of the year, accounting major Deloitte said.

WuXi, which was founded in 2000, is a contract research organisation that helps drug makers shorten their discovery and development procedures.

It took just 50 days to gain approval for a float in Shanghai, a sharp contrast to the normal regulatory approval process which takes an average of 519 days, according to Shenwan Hongyuan Group.

Its affiliate WuXi Biologics went public in Hong Kong in June 2017, raising HK$3.98 billion.