Xiaomi IPO gets lukewarm reception as institutional investors question pricing

Founder Lei Jun says smartphone maker should be valued as a ‘hybrid of Tencent and Apple’ as investors question IPO pricing

Xiaomi’s initial public offering was met with a lukewarm response by institutional investors, many of them put off by what they see as a high valuation based on the company’s claim that it is an “internet company” rather than a hardware maker.

Lei Jun, the entrepreneur who took the company from a start-up to world’s No. 4 phone maker, said on Thursday Xiaomi should be valued as high as “a hybrid of Tencent and Apple”.

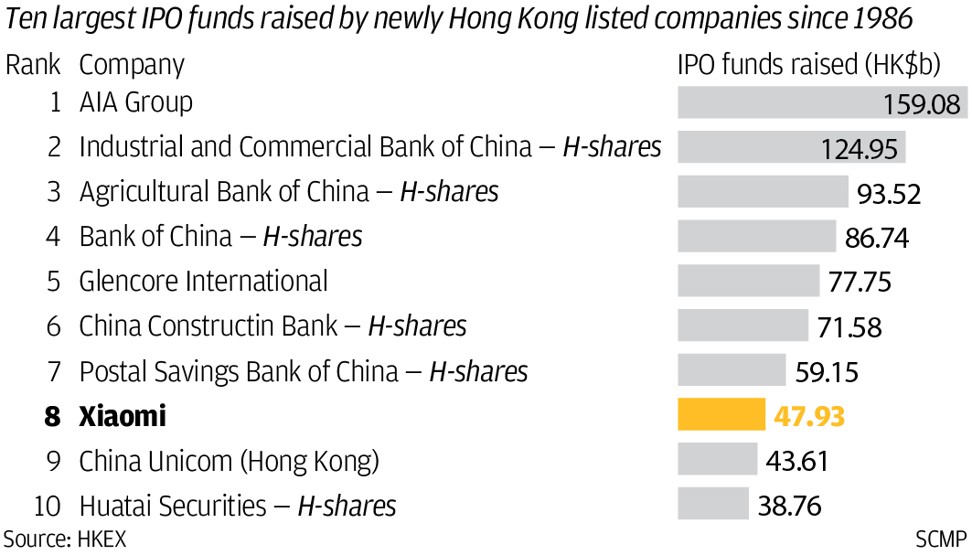

The Chinese smartphone maker started taking orders from institutional investors on Thursday for its US$6.1 billion Hong Kong offering, the biggest technology IPO in the world since Alibaba’s US$25 billion listing in 2014. The flotation is also the largest in Hong Kong since Postal Savings Bank of China raised US$7.4 billion in 2016.

Xiaomi plans to offer 2.18 billion shares in an indicative price range of between HK$17 to HK$22. Only 5 per cent are for public sale, while the rest are targeted toward global institutional investors.

The share price would value the company in a range between US$54 billion and US$70 billion, well short of its initial target of US$100 billion.

The pricing of the IPO, and therefore the valuation of the company, has been a bone of contention for investors and regulators. Xiaomi has been presenting itself as an “internet company” rather than a hardware maker, even though the vast majority of its revenues come from smartphone sales.

Companies billed as manufacturers, like tech giant Apple, tend to achieve much lower valuations than those categorised as internet firms, like China’s Tencent.

Lei Jun, who founded Xiaomi in 2010 and currently chairs the company with a 31.4 per cent stake, said at a presentation to institutional investors on Thursday that the smartphone maker should be valued as a hybrid of Apple and Tencent because it is “driven by innovation”.

Not everyone in the room was buying it.

Some investors who attended the road show at the Shangri-La hotel in Hong Kong said they were not fully convinced of Xiaomi’s claim in its prospectus that it is an “internet company”, a designation likely to give it a higher valuation. For them, the valuation still does not look attractive even though it has been trimmed significantly.

“The high point [of the IPO price range] is too expensive,” said Alex Au, managing director of Alphalex Capital Management, a Hong Kong-based hedge fund.

“The pricing is the concern for international investors,” said Ronald Wan, chief executive of Partners Capital. “Unlike domestic Chinese investors, who frequently go nuts for big unicorns, international investors are more inclined to take a value-investing approach. That’s the question they keep asking Xiaomi.”

Xiaomi has positioned itself as an internet company, which would allow it to achieve a higher valuation than if it was categorised as a manufacturer of hardware. The financial watchdog has asked Xiaomi to justify this assertion, given that smartphone sales account for more than 70 per cent of total revenues, while its internet business makes up less than 10 per cent.

Apple, as a hardware maker, has a current price to earnings (P/E) ratio of 18, while Alibaba and Tencent, both positioned as internet companies, have P/E ratios above 40.

“If categorised as a manufacturer, it will be hard for Xiaomi to convince investors they can achieve a higher valuation than Apple,” Wan said.

On Tuesday, Xiaomi announced it would postpone its original plan to issue so-called China depository receipts (CDRs) in the domestic market, and instead go ahead with its Hong Kong flotation first. Xiaomi had been aiming to raise as much as US$10 billion in its IPO, splitting the shares between Hong Kong and Shanghai.

The firm did not provide a reason for its sudden change of tack, but the decision came within days of the regulator appearing to challenge the pricing of the IPO. The China Securities Regulatory Commission sent Xiaomi a list of 84 questions last week in response to its latest IPO prospectus, including the one asking whether it is truly an internet firm.

“I think that could be one of the reasons why Xiaomi pulled back [from the CDR],” Wan said.

Still, some investors attending the presentation felt there is something unique about the Chinese entrepreneur behind Xiaomi, and were willing to trust in the company’s future based on that alone.

Jessica Bell, director of Phillip Capital in Australia, said she was “satisfied by what Lei presented”.

“People matter. It is better to watch Lei Jun presenting himself than reading the documents. And we think the core competitiveness of Xiaomi is Lei and his people. We are positive on that,” she said.

Zhu Chao, chief executive officer of Asset Pro, a Beijing-based overseas-asset service provider for Chinese wealth managers, said he feels excited about Xiaomi’s future growth in foreign markets such as India and Southeast Asia. “The current pricing looks reasonable to me, he added.

Kyle Su, managing director of Kadensa Capital from the US, said the price range makes Xiaomi not “as expensive as expected”. HK$17 may be acceptable for most potential investors, he said.

Seven cornerstone investors, who will lock up the shares for six months, have agreed to acquire US$548 million worth of shares, according to the prospectus.

US chip maker Qualcomm has committed US$100 million, the only foreign company among the cornerstone investors. China Mobile, the country’s biggest telecom operator, will also invest US$100 million in Xiaomi.

CICFH Entertainment, a state-backed industrial fund, will be the biggest cornerstone investor with an input of US$192 million.

Xiaomi plans to use 30 per cent of the proceeds for research and development, 30 per cent to expand and strengthen its capability in the so-called internet of things, 30 per cent for global expansion, and the rest for working capital and other corporate purposes.