Investors in mad scramble for margin loans as US$1.12b Good Doctor IPO lights up market

IPO of China’s largest online medical services platform set to outshine ZhongAn Online’s HK$11.9b offering last September

The scorching hot IPO of Ping An Good Doctor, the first unicorn to hit Hong Kong in 2018, has sparked such massive retail fervour that brokers have so far extended more than HK$160 billion (US$20.3 billion) in margin loans to retail clients keen on getting their hands on the shares.

The margin loans extended to retail investors easily outstrips the shares on offer and has far surpassed the HK$12.5 billion extended to investors for China Literature’s IPO last November.

Good Doctor, formally known as Ping An Healthcare and Technology, aims to raise as much as HK$8.77 billion (US$1.12 billion) from the sale of just over 160 million shares.

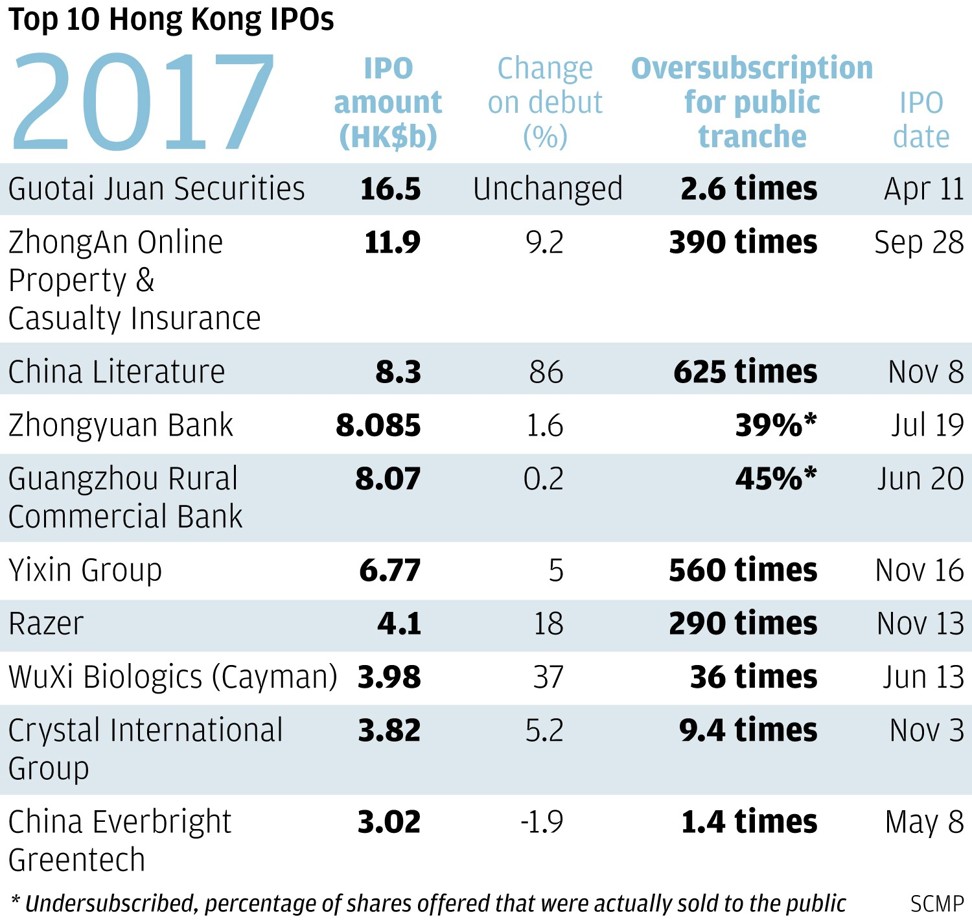

The IPO, Hong Kong’s most valuable so far this year, is set to become the biggest flotation by an internet-based business since ZhongAn Online P&C Insurance’s HK$11.9 billion last September.

By Thursday morning, 17 brokerage firms had extended about HK$168 billion to their margin clients, more than 290 times the value of shares offered to the public, reflecting the huge gap between investor demand and supply.

Brokerages and banks in the city make margin loans to retail investors for selected IPOs, which can be up to 90 per cent of the value of shares subscribed.

China Literature was the most chased IPO in Hong Kong in a decade, attracting total retail investor capital of more than HK$520 billion, only second to China Railway Construction’s HK$535 billion in 2008. Retail investors had submitted bids to buy 625 times more than what China Literature had on offer.

China Literature raised HK$8.3 billion from its IPO in November.

“It’s possible Good Doctor can attract more investor capital [than China Literature], as there were several hot IPOs at the end of last year which had diluted retail interest,” said Edmond Hui, chief executive at Hong Kong-based Bright Smart Securities.

Linus Yip, chief strategist for First Shanghai Securities, said the timing had worked in Good Doctor’s favour drawing interest from investors. “It has a new economy concept and comes just as Hong Kong launches its listing rule reform making it easier for new economy companies to list here,” said Yip.

But Alvin Cheung, associate director for Prudential Brokerage, was more cautious on whether Good Doctor could surpass China Literature to become the hottest IPO in recent years.

He said Hong Kong stock market is faced with more uncertainties this year, including how the trade dispute between the US and China could evolve and risk of rising interest rates in Hong Kong as the Fed appears to have turned more hawkish.

Wang Tao, the medical service app’s chairman and chief executive, said during the company’s IPO launch on Sunday in Hong Kong that the IPO proceeds would be used to expand “our business, and fund future domestic and overseas acquisitions”.

According to the prospectus, around 40 per cent of the net proceeds will be used for business expansion, such as its e-commerce business, hiring sales and medical professionals, acquiring new users and funding marketing activities.

A spin-off of Ping An Insurance Group, Good Doctor is currently China’s largest online health care and medical platform in terms of users, with some 193 million registered users at the end of 2017.

The company posted a 2017 loss of 1 billion yuan (US$158.86 million), its third annual loss, but Lee Yuansiong, deputy chief executive at Ping An Insurance Group, said that it was normal for a tech unicorn in its early phase.