A company as an economy? Alibaba says it can be world’s fifth-largest by 2036

E-commerce giant will serve 2 billion customers and support 10 million businesses on its platforms in 19 years’ time, says founder Jack Ma

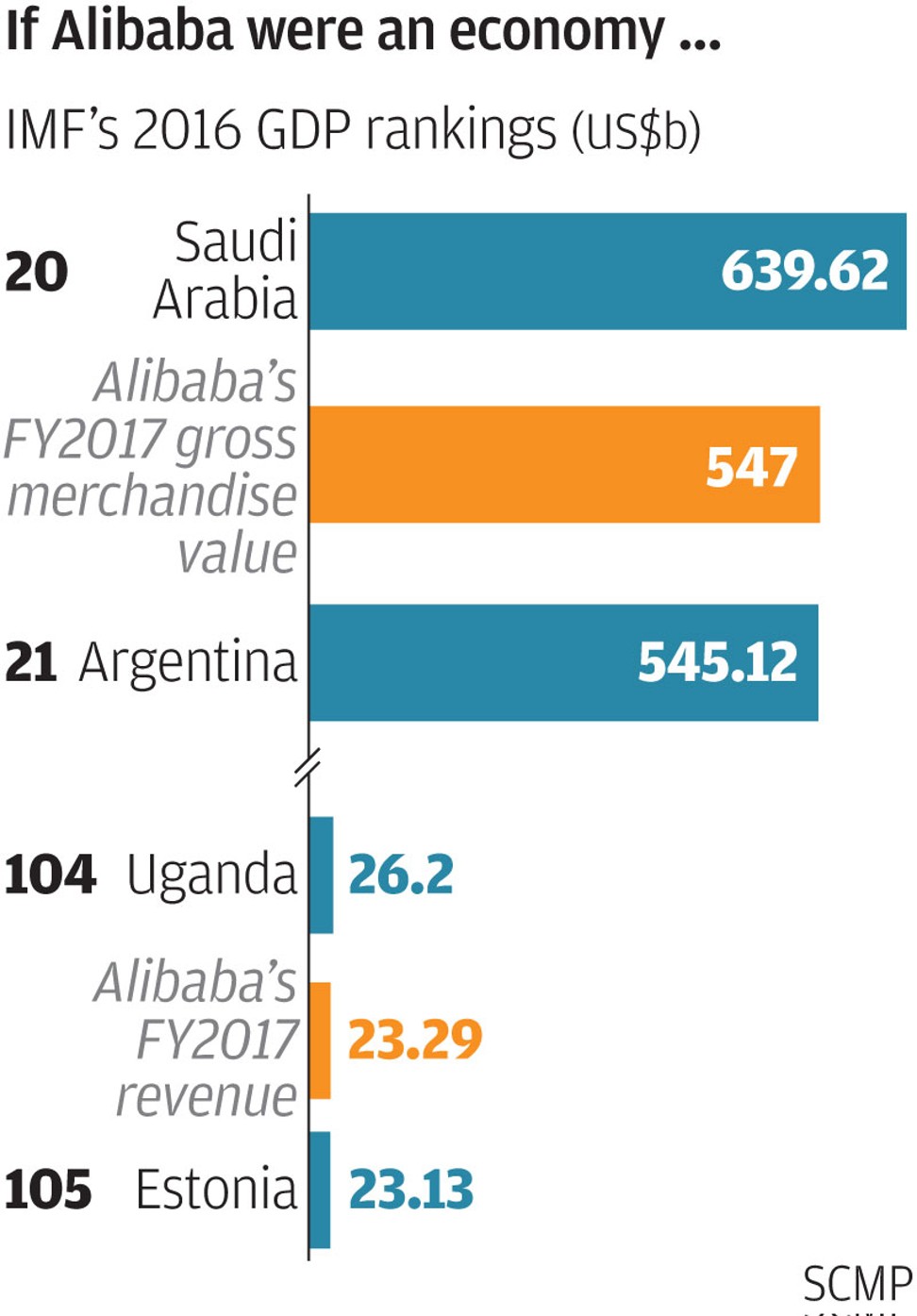

Alibaba Group Holding, the world’s largest e-commerce platform operator, aims to become the fifth-largest “economy” in the world by 2036, founder Jack Ma Yun said on Friday.

In 19 years’ time, the technology giant would have created 100 million jobs and would support 10 million profitable businesses on its platforms as it strove to become a global business in the truest sense, serving as many as two billion consumers worldwide, the executive chairman told about 400 investors at its headquarters in Hangzhou.

“If a company can serve two billion consumers, that is one-third of the total population of the world. If a company can create 100 million jobs, that is probably bigger than most governments can do. If a company can support 10 million profitable businesses on its platform, this is called an economy,” Ma told the audience.

At that point, Alibaba would become the No 5 “economy” in the world, just behind the United States, China, Europe and Japan, Ma said, without specifying the company’s projected gross merchandise value number by that year.

The idea of companies as economies is not new. General Electric and Wal-Mart Stores, among the largest companies on the planet with the most extensive network of operations, have been compared to sovereign economies in the past. Wal-Mart’s 2002 sales rivalled the world’s 22nd-biggest economy, Australia.

Current international commercial trading practices are not helping small and medium-sized enterprises survive as big companies are expanding across the continents and eroding the market share of smaller players. People are also worried that they will lose their jobs as machines become more widely adopted.

Hangzhou-based Alibaba, which owns the South China Morning Post, is determined to become a global company that places importance on inclusivity by supporting small businesses and helping young people, according to Ma.

Targeting two billion consumers by 2036, of whom an estimated 800 million would be Chinese, meant Alibaba would look for 1.2 billion more consumers outside its home country, he added.

The company had been actively looking for investment and acquisition opportunities in a way that ensured the sustainable growth of the group, executive vice-chairman Joe Tsai said at the same event.

Over the past two years, Alibaba’s strategic investments have totalled US$21 billion, spread across various business sectors including digital media, entertainment, logistics, new retail and social media.

Alibaba’s future success will be driven by its ability to use data to increase user engagement further and deepen its relationships with brands

Alibaba has also become the most valuable Asian company as its stock surged after it projected on Thursday that sales in the 2018 financial year might increase by up to 49 per cent, 10 percentage points higher than estimates.

Its New York-traded shares jumped 13.3 per cent to a record US$142.30 on Thursday, boosting its market capitalisation to US$360 billion.

Shares of Alibaba’s nearest rival in Asia, Tencent Holdings, gained 1.5 per cent to close at HK$277.40 on Friday in Hong Kong. Tencent’s total capitalisation of HK$2.6 trillion (US$333 billion) on Friday is about 8 per cent lower than Alibaba’s at the close on Thursday.

Alibaba’s success rests on two factors: as an early mover, it met untapped consumer demand and now boasts 507 million mobile monthly active users, while its huge user base has also made it a valuable partner for brands, according to Tsang Chi, HSBC’s head of internet research in Asia-Pacific.

“Alibaba’s future success will be driven by its ability to use data to increase user engagement further and deepen its relationships with brands,” Tsang wrote in a report dated June 9.

“Indeed, revenue guidance that far exceeded expectations and deep-dive discussions at its 2017 investor day indicate we are at the beginning of data-driven monetisation,” Tsang said.

HSBC has inflated its target price for Alibaba’s shares to US$162 from US$145 previously. The new projection is 13.8 per cent higher than the price at the close on Thursday in New York.