Update | Hong Kong government pledges cautious approach to easing mortgage plight of first-time buyers

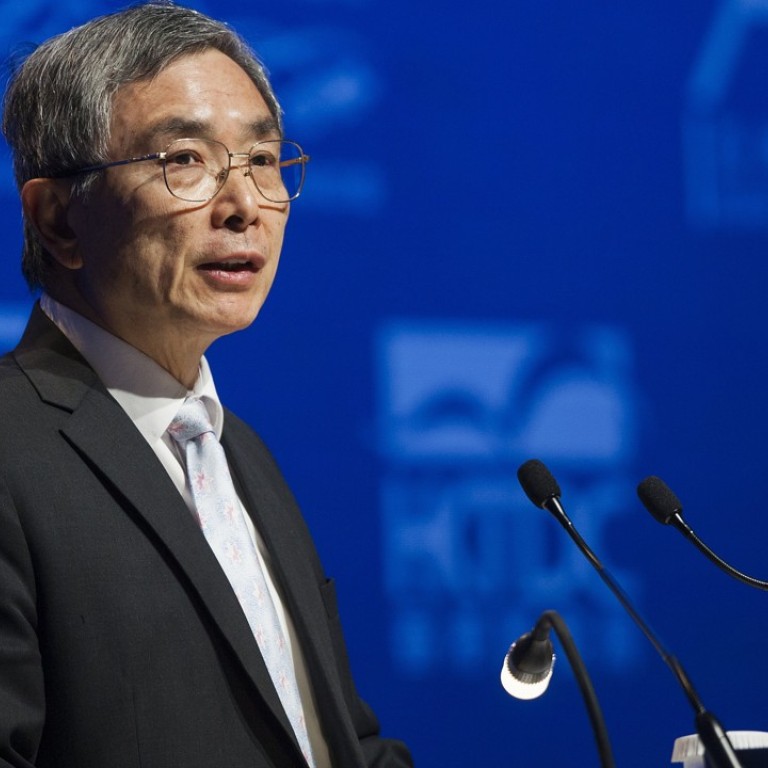

‘Any potential changes to the mortgage policy would be aimed solely at helping first-home buyers … it does not mean the government has any intention of relaxing the many policies that were introduced to curb property prices’, says James Lau, secretary for financial services and the treasury

The Hong Kong government is taking a cautious approach in the plans to review its mortgage policy for first-time buyers, according to James Lau, the secretary for financial services and the treasury – but any such move must be carefully thought out, so as not to add further fuel to what is an already overheating property market in the city.

“The government needs to be very cautious in launching any mortgage policy aimed at helping youngsters or any other members of the public to buy their own home,” Lau said on the sidelines of the 11th Asian Financial Forum in Hong Kong. “We need to ensure any new policy simply doesn’t make it easier for speculators to re-stimulate the property market further.”

“Let me make it quite clear – any potential changes to the mortgage policy would be aimed solely at helping first-home buyers. And it does not mean the government has any intention of relaxing any of the many policies introduced to curb property prices,” Lau said.

His remarks came after Financial Secretary Paul Chan Mo-po last week told lawmakers that the government-owned Hong Kong Mortgage Corporation (HKMC) was considering new policies to help youngsters or first-time homebuyers.

HKMC is now considering offering mortgage insurance to help people who do not have enough money to pay 30 per cent of the value as the initial down payment, meaning they can get 90 per cent mortgages. Again, Lau said HKMC would consider this cautiously.

Lau said that, besides mortgage policies, the government was also working hard to increase the supply of land to be released to developers on which to build new properties, aimed at lower-end buyers.

Sun Hung Kai Properties, Hong Kong’s largest developer by market value, last week called on the corporation to ease its lending scheme for mass-market flats.

Last year, the average price of a new flat rose 16.9 per cent to HK$12.57 million each from 2016, according to Ricacorp Properties. The price for used flats grew slower, at about 13 per cent, in 2017.

“We will work hard to meet the demands of the public in helping them buy their own home. But as mentioned, we have to make sure these measures don’t in any way help speculators from inflating prices,” Lau said.

‘The IMF is positive about the economic outlook globally in 2018. The US’s monetary policy also affects capital flow. The Hong Kong stock market is rising along with this momentum,” Lau said.

But Lau underlined the government’s strong stance, however, saying that it does not accept the Hong Kong Exchanges and Clearing’s suggestion of changing or scrapping stock stamp duties.

“Stock stamp duty is an important source of government income. The government has no intention to change it,” he said.

Financial Secretary Chan – who was also at Monday’s forum – told a Legislative Council meeting last week: “The government has plans to review the mortgage policy to help youngsters buy their own home.

“However, there will be no moves to cut down on the level of ‘spicy measures’ we have introduced over the past few years to cool down the property market.”

Hong Kong has introduced a range of tough measures – dubbed “spicy” by the public – such as double stamp duties and tightening mortgage lending policies, to cool down the overheating market.

Chan said he was very concerned about how to help young people gain a mortgage to buy a flat so a review of the mortgage policy was on agenda, but that does not mean the government wants to relax any of its anti-speculative policies.

Chan also said last week that property prices in November were double those at the peak of 1997 while the percentage of household income to pay their home loans reached 68 per cent in the third quarter of last year.

The potential interest rate rises this year as well as the increase supply of property this year and next year would add pressure to property market, he said.

(Corrects the story first published on January 15, to remove references to Lau’s comment about the right of Hong Kong citizens to own their homes, which was erroneously attributed to him.)