China’s yuppies think US$462,300 needed to raise, educate a child, study shows

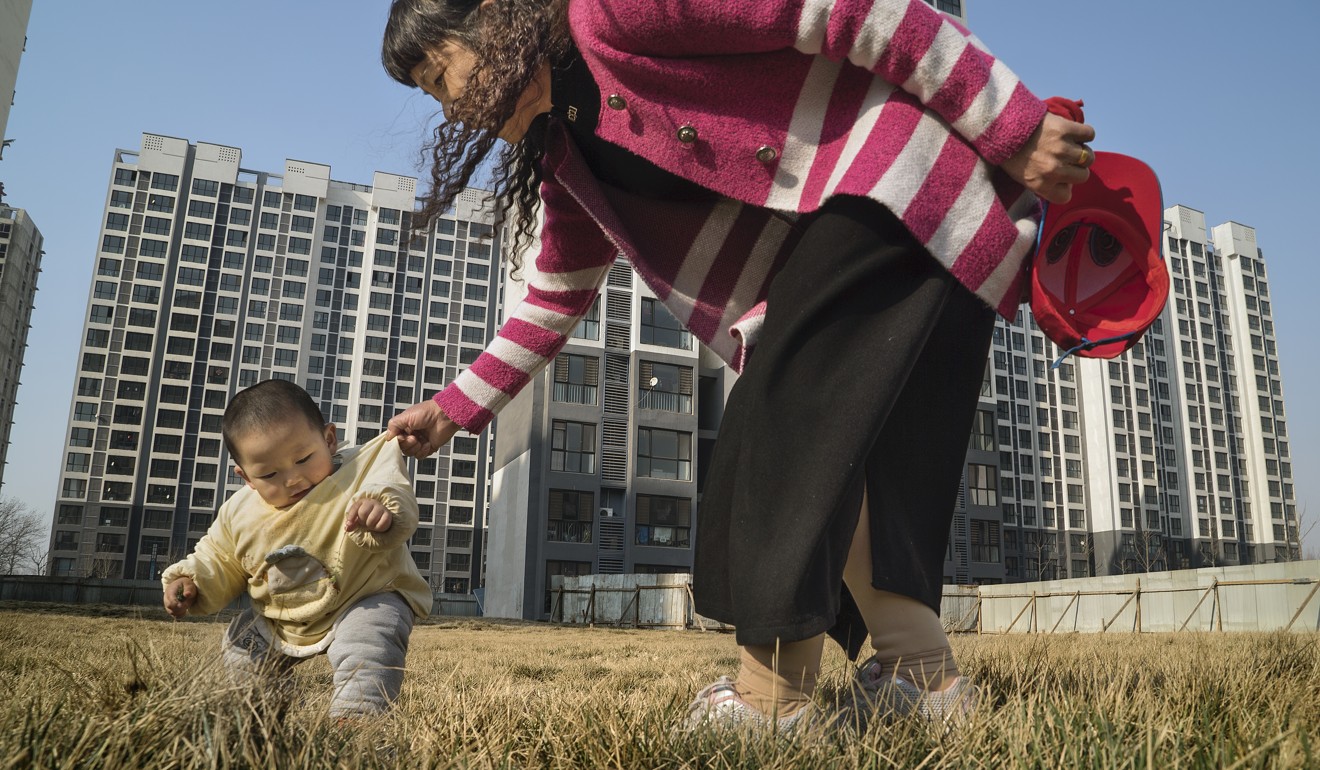

High stress levels are seen among young urban Chinese families who anticipate setting aside 3.1 million yuan to fund their children’s education, marriage and first home, survey finds

China’s emerging affluent are pinched by financial stress as they anticipate setting aside 3.1 million yuan (US$462,300) for their children, including funding their education, marriage and even a first home, according to a survey.

These individuals expect to set aside 1.27 million yuan for educational expenditures such as overseas studies and 1.83 million yuan for early adulthood outlays, such as wedding costs and a first home, said a joint report by Charles Schwab and the Shanghai Advanced Institute of Finance.

The report released Wednesday polled more than 2,600 respondents with a personal annual income between 125,000 yuan to 1 million yuan between May and June to gauge their financial goals and wealth management behaviour.

Saving for children is the top financial concern for Chinese families acquiring wealth, which stands in sharp contrast to trends in the United States.

“That is a very specific attribute of the Chinese investors and the rising affluent in particular,” said Lisa Hunt, executive vice-president, international services and special business development at Charles Schwab, in Shanghai on Wednesday.

“There is often no family support for education [in the United States] … certainly not the support with respect to getting married or buying a first home or even helping with starting a business,” she said. “That really doesn’t happen in the United States.”

The top financial concern among US households is for one’s own retirement, with the financial stress from raising the next generation abating once children reach 18.

For aspiring Chinese families, the ambitious financial target is generating a high degree of anxiety as 56 per cent of respondents said raising funds for their children was either “stressful” or “very stressful”. Stress levels were even found to be high among individuals that have yet to form a family.

Additional concerns, such as stress related to rising medical bills, resulted in a rethink of the financial sums needed to remain financially comfortable this year.

Respondents estimated that 1.82 million yuan in liquid assets was needed to be financially comfortable, up 47 per cent from a year earlier. Assets of 4.25 million yuan were regarded as the benchmark for being rich, up 18 per cent from a year earlier.

China’s emerging wealthy individuals also increasingly view property as a core part of their financial future. About 96 per cent of respondents own property, while 37 per cent own at least two homes.

The survey was conducted online in Beijing, Shanghai, Guangzhou, Chengdu, Hangzhou, Dalian, Xiamen, Chongqing and Wuhan. About 44 per cent of respondents were aged between 25 to 34.