Hong Kong Monetary Authority steps in to prop up currency as dollar falls to 35-year low

HKMA chief executive Norman Chan says the city’s de facto central bank is fully capable of maintaining the stability of the Hong Kong dollar and there is no need to be concerned

Hong Kong’s de facto central bank, the Hong Kong Monetary Authority (HKMA), triggered the weak-side convertibility undertaking by selling US dollars late on Thursday evening after the Hong Kong dollar deteriorated to 7.8500 per US dollar, its weakest level in 35 years and touching the lower limit of its trading band for the first time.

“The HKMA sold US$104 million at 7.8500, the aggregate balance will be reduced by HK$816 million to HK$178,961 million on April 16,” an HKMA spokesperson said in a statement.

Norman Chan, the HKMA chief executive said: “This is the first time that the weak-side CU of 7.85 is triggered after the HKMA shifted the weak-side CU to that level in 2005, as part of the ‘Three Refinements’ to the operation of the Linked Exchange Rate System (LERS). I reiterate that the HKMA will buy Hong Kong dollar (HKD) and sell USD at 7.85 level to ensure that the HKD exchange rate will not weaken beyond 7.8500. Such operations are normal and in accordance with the design of the LERS.

“Depending on capital flows, the weak-side CU may be triggered again in the future. The HKMA is fully capable of maintaining the stability of the HKD and managing large scale capital flows. There is no need to be concerned.”

Earlier on Thursday, the HKMA had said it would not necessarily step in to prop up the currency.

Traders said rising market uncertainty amid trade tensions was to blame, and that US-Hong Kong interest rate differentials continue to widen.

The city’s currency breached the critical level in the early hours of Thursday morning and several times again in the late afternoon before pulling back. It stood at 7.8499 at 5:30pm.

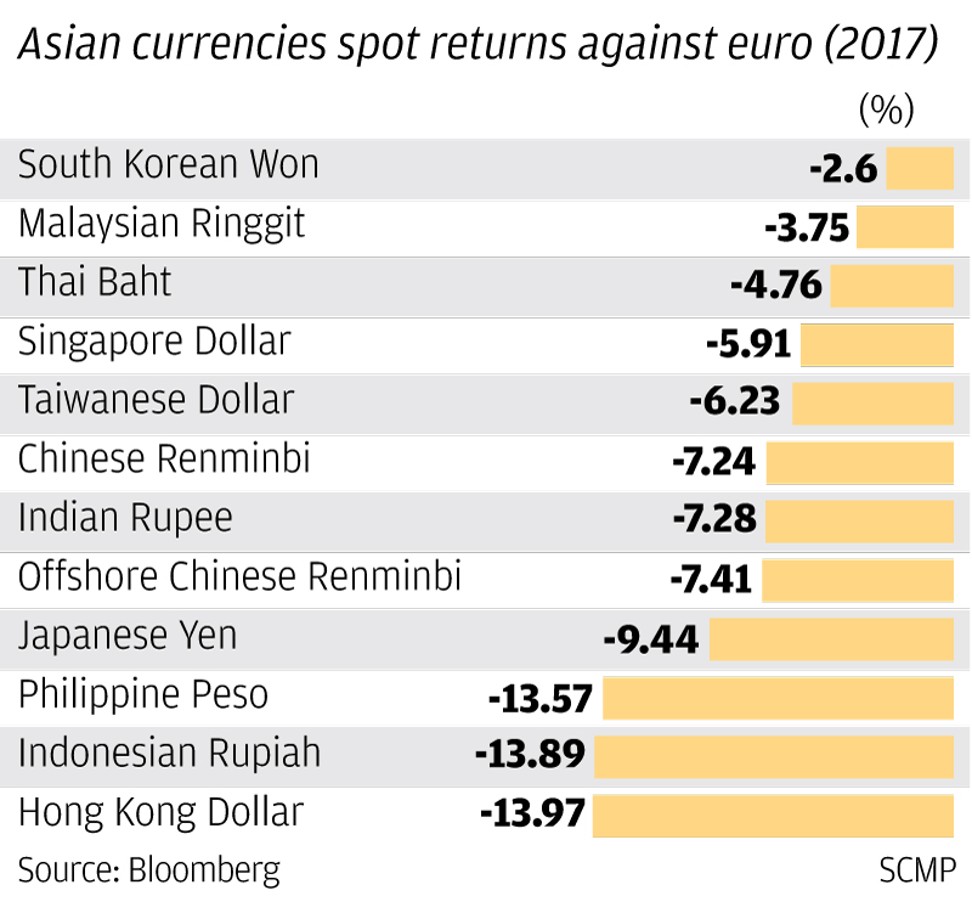

The city’s dollar, pegged at 7.8 per US dollar since October 1983, with the trading band of 7.75 to 7.85 introduced in 2005, has been one of the biggest losers among a dozen Asian currencies in the past year, declining by almost 14 per cent against the euro and 7 per cent against the renminbi.

Market players had been expecting the HKMA to intervene to keep the currency within the trading band and engineer a gradual rise in the HK dollar Hibor (the Hong Kong interbank offered rate) rate as it gradually shrinks Hong Kong’s abundant liquidity.

But the Hong Kong dollar’s pull back on Thursday showed selling pressure was contained, given that liquidity remained flush in the banking system as money flow into the city’s stock and property markets, analysts said.

Frances Cheung, Westpac Banking’s Asia head of macro strategy said that uncertainty continued to linger over the ongoing trade tensions between the US and China, while increasing Hong Kong dollar-denominated loans by Chinese companies used outside the city, were fuelling capital outflows and keeping the currency near the weak end of trading band.

“The Hong Kong dollar may repeatedly hit the 7.85 level in the coming months. But it is still uncertain if the HKMA can step in and withdraw enough funds to push up interest rates more rapidly,” she added.

Hong Kong’s economy, a major transshipment centre for Chinese exports and a banking hub for cross-border trade financing, would be hurt if a trade tussle escalates, or is prolonged.

A spokesperson for the HKMA said that it would intervene and buy Hong Kong dollars, only upon bank requests.

“Even if the Hong Kong dollar weakens to the 7.85 level, so long as other banks are willing to buy Hong Kong dollars at that level, the interbank market will continue to buy and sell [them] at 7.85.

“In other words, the weakening of the HKD to 7.85 does not necessarily mean that the HKMA’s weak-side convertibility undertaking has been, or will be, triggered.”

For more than a year, foreign exchange traders have been actively selling Hong Kong dollars and buying the US currency in an arbitrage called the carry trade, which sells a low-yielding asset to buy another with higher returns, as they took advantage of the price difference between their borrowing costs.

The cost of borrowing capital locally, the Hibor rate, has been rising across all maturities in the past year, reflecting a slight overall tightening of funds in the city.

For example, one-month Hibor has risen about 37 basis points while three-month Hibor has increased 24 basis points.

This has widened the Hibor-Libor spread, allowing traders to continue making arbitrage trades, which in turn exerts depreciation pressure on the local currency.

Markets are pricing in for the Fed to raise interest rates three or four times this year, adding to upward pressure on Libor. On Wednesday, minutes released of the US central bank’s last policy meeting on March 20-21 showed all of the Federal Reserve’s policymakers felt the US economy would firm further, and inflation would rise in the coming months.

“The HKD weakening was driven by the widening HKD-USD rate spread amid Fed’s rate hike cycle

Looking forward, we expect HKD to hover around 7.849 to 7.85 in the very near term,” said Ken Cheung Kin Tai, senior Asian FX strategist at Mizuho Bank.

A sign showing how ample liquidity was in the city is the unchanged prime lending rates of commercial banks since 2008 even as they raised interest rates on savings.

On Thursday, Bank of China Hong Kong increased its three-month fixed rate deposits on its Hong Kong dollar-denominated accounts by 25 basis points to 1 per cent and on its US dollar-denominated accounts by 40 bps to 1.9 per cent.

Jasper Lo Cho-yan, senior vice-president at iBest Finance, however said that even those fixed deposit rates were likely to stabilise soon because Hibor rates have actually been moderating this month.

“Deposit rates have been rising as banks compete for business but that is likely to stabilise in line with Hibor,” he said