Hong Kong, Singapore prime property prices to see big declines as high rates weigh on sentiment: Savills

- Hong Kong is likely to see the biggest price decline of up to 10 per cent and as much as 3.9 per cent in Singapore, according to a Savills report

- Prime residential property in the 30 cities monitored by Savills to see overall price growth of 0.6 per cent this year versus 2.2 per cent in 2023

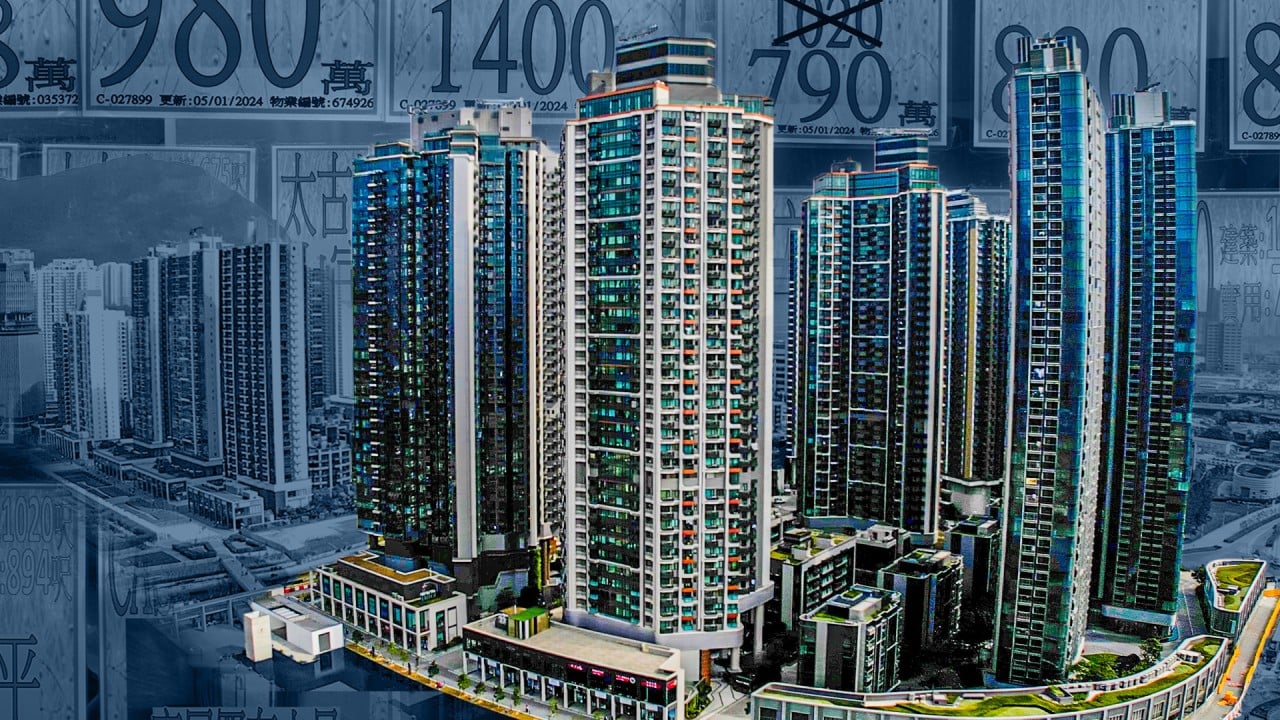

Hong Kong and Singapore are among major global cities that will see residential property prices fall this year, as high interest rates and a challenging economic landscape continue to dampen sentiment, according to a report by Savills World Research.

Of the 30 global cities monitored in the Savills World Prime Residential Index, 17 will see price falls, with Hong Kong projected to see the highest decline of up to 10 per cent and Singapore is likely to post a drop of 3.9 per cent.

Overall, positive prime residential price growth of 0.6 per cent is projected for the year, compared with 2.2 per cent in 2023.

“Inflationary pressures will gradually abate, necessitating ‘higher for longer’ interest rates and the likelihood of a sustained period of weak global growth,” said Kelcie Sellers, an associate at Savills World Research.

Other cities projected to see price declines this year include London, New York, San Francisco, Los Angeles and Seoul. Capital value growth in these cities is expected to be slower than in 2023.

Even though prime residential property is less mortgage-reliant than mainstream residential property, weaker macroeconomic conditions are expected to dent sentiment. As a result, many potential buyers and sellers are likely to adopt a wait-and-see approach in an environment with higher interest rates.

Peak distress: Hong Kong luxury property owners turn to pricey private loans

Late last year, Hong Kong reversed a range of property cooling measures in place since late 2010 to revive a moribund residential market. These included halving buyers’ stamp duty to 7.5 per cent for non-permanent residents and waiving a special stamp duty of around 10 per cent of the home price for owners who resell property after two years from three years previously.

But the market continues to remain soft amid higher mortgage rates, which are likely to remain elevated until at least the second half of the year when the Federal Reserve moves to reduce borrowing costs.

A softer market, however, presents opportunities for high-net-worth individuals to buy property in prime locations, according to market observers.

“Wealthy families will take this opportunity to invest for the next generation,” said George Tan, a managing director of Livethere Residential at Savills Singapore.

While Singapore’s high-end residential market was affected by the imposition of a 60 per cent levy on foreign buyers, “the relatively low supply in this segment will allow the market to find a price floor and, over time, create a stronger foundation”, said Alan Cheong, head of research at Savills Singapore.

And with less new supply from 2025 onwards in the city state’s high-end residential market, prices are likely to stabilise soon, he added.

In mainland China, Guangzhou, Hangzhou and Shenzhen will see price falls over the course of the year, according to Savills.

Sydney and Dubai are forecast to be the two top performers this year, with both cities set to benefit from an increase in their high-net-worth population.

Sydney has been witnessing high demand for quality prime homes, but supply remains low, according to Savills. This imbalance is likely to persist throughout 2024 and push up prices, which are predicted to increase by 8 per cent to 9.9 per cent.

The growth of prime property prices in Dubai, which increased by 17.4 per cent in 2023, is likely to slow this year as the property consultancy expects market activity to return to normal. Prices are anticipated to grow by 4 per cent to 5.9 per cent this year, according to Savills.

Generally, markets with comparatively lower price points than other world cities look likely to perform well over this year.

Cape Town, Barcelona, Madrid and Kuala Lumpur, which each boast prices below US$800 per square foot, are forecast to see the highest growth after Sydney and Dubai, Savills said.

Additional reporting by the Post